Crypto This Week: Get Ready! Polygon Labs to Launch “Value Layer” of the Internet through Polygon 2.0 Upgrade

What Happened in the Crypto Industry & NOBI During the Past Week?

Hi, NOBI’s! This week has been full of exciting events. Polygon Labs is getting ready to unleash the “Value Layer” internet with the Polygon 2.0 upgrade. Despite the storms, Bitcoin and some top altcoins are still sparkling brightly. And hold on tight, because Uniswap has some thrilling news too. They’ve revealed their vision for V4, introducing game-changing “hooks” features that slash pool creation costs by a whopping 99%. There’s always more hot news on the horizon. Check out our special crypto news roundup of the past week!

1. Get Ready! Polygon Labs to Launch “Value Layer” of the Internet through Polygon 2.0 Upgrade

Ethereum’s layer-2 scalability platform, Polygon, has recently announced the launch of Polygon 2.0, aiming to become the “Value Layer” of the internet. The upgrade is set to serve as the foundational layer for creating, exchanging, and programming value, with the goal of democratizing the global economy, similar to how the internet has successfully democratized access to information.

Polygon Labs, through a tweet on June 13, 2023, unveiled their plans for launching Polygon 2.0 to build the Value Layer of the internet. They explained that while the internet enables anyone to create and exchange information, the Value Layer will enable anyone to create, exchange, and program value.

This latest upgrade from Polygon introduces an advanced zero-knowledge-based layer-2 network. With an innovative cross-chain coordination protocol, Polygon has successfully connected these various networks in an efficient and effective manner.

2. Amid Industry Turmoil, Bitcoin and Top Altcoins Remain Resilient

During the past week, Bitcoin and select top altcoins have demonstrated their resilience despite continued selling pressure in the crypto market. Increased regulatory scrutiny in the crypto sector has also sparked concerns among investors. However, the total market capitalization of the crypto market has remained steadfast above $1 trillion.

Over the past eight weeks, a bearish trend formation has weighed on the prices of several crypto assets, leading to a decline in the total market capitalization to its lowest level in over two months at $1.06 trillion, representing a 2.4% decrease between June 4th and June 11th. Interestingly, this decline was not driven by the “king of crypto” itself, as Bitcoin (BTC) actually saw a 0.8% increase during the seven-day period.

On the other hand, the negative pressure came from a number of altcoins that experienced drops of over 15%, including BNB, Cardano, Solana, Polygon, and Polkadot. However, there is good news as these five altcoins have started to recover, with Cardano (ADA) leading the way with a 1.64% increase in the past 24 hours at the time of writing (June 16th). Additionally, there is positive news for Tether (USDT) as its demand in Asia has shown notable resilience.

3. Rapid Increase: Bappebti Announces 501 Legal Crypto Assets in Indonesia, Including HNST

Fresh breeze blows in the crypto world in Indonesia as the Commodity Futures Trading Regulatory Agency (Bappebti) has recently released a new list of crypto assets eligible for trading in Indonesia’s physical crypto market. What makes it interesting is that one of the crypto assets included in the list is Honest (HNST), the native crypto of NOBI.

In the latest regulation by Bappebti, there are now 501 crypto assets that can be traded in the physical crypto market. This represents a significant increase compared to the previous list, which only covered 383 crypto assets. The regulation came into effect on June 9, 2023. This is certainly an exciting development in the crypto industry in Indonesia, and we can expect more innovation and growth in the future.

4. Tightening Crypto Regulations in the US Benefit the Asian Bitcoin Market

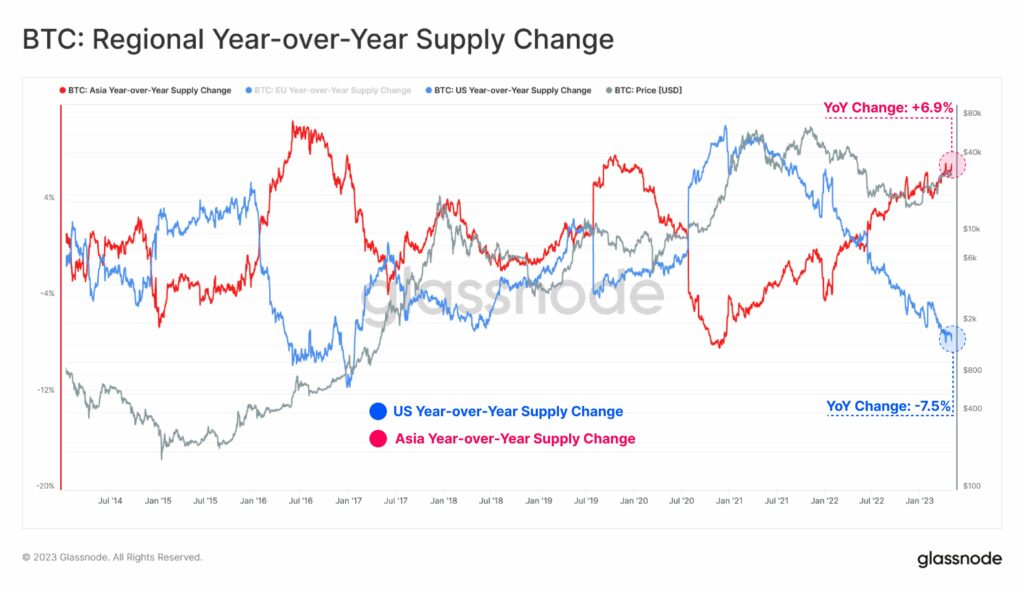

A recent report indicates that the Bitcoin reserves on international exchanges continue to increase, while there has been a decrease in the United States. According to CryptoQuant, the Bitcoin reserves in the US are currently at their lowest level since January 2017. On the other hand, the majority of Bitcoin reserves, around 51%, are held on international exchanges.

It appears that the values of both metrics have been moving in opposite directions in recent months | Source: Glassnode on Twitter

According to Glassnode, entities operating during Asian trading hours have seen a 9.9% increase in their Bitcoin holdings since June of last year. This figure represents an all-time high, indicating strong interest in the cryptocurrency asset in the Asian region. Crypto market participants in Asia appear to be increasingly active and involved in Bitcoin ownership. This also reflects a shift in the global distribution of Bitcoin ownership.

5. Uniswap Unveils Vision for V4, Introduces Innovative “Hooks” Feature and Slashes Pool Creation Fees by 99%

Uniswap, one of the largest decentralized exchanges (DEX) based on trading volume, has recently unveiled their vision for Uniswap V4. In their announcement, they have also called upon the community members to provide feedback and contribute to the project.

One of the notable features that has caught the attention of the community is the “hooks” feature. According to Bankless, this feature will allow for highly customizable pool creation, with dynamic fee structures, on-chain limit orders, and time-weighted average market orders.

🦄 Uniswap V4 Revealed 🦄

— Bankless (@BanklessHQ) June 13, 2023

DeFi's leading DEX is getting a big upgrade. Here's everything you need to know

A THREAD 🧵👇

(1/9) pic.twitter.com/iyWZjN1my6

But it doesn’t stop there. Uniswap is also committed to reducing pool creation fees by up to 99% by incorporating all these features into a single smart contract. This is expected to enhance efficiency and accessibility for Uniswap users.

That wraps up for Crypto This Week. We’ll see you at the next one!