What Happened in the Crypto Industry & NOBI During the Past Week?

Hello, NOBIs! Numerous surprises arose in the crypto space during the second week of 2023. Started with a remarkable spike in the price of Solana (SOL), which has attracted investor interest. Then, another news emerged from the web3 industry, which is projected to achieve a valuation of IDR824.45 trillion in less than ten years. What else? We recap what’s been happening in the crypto industry during the past week!

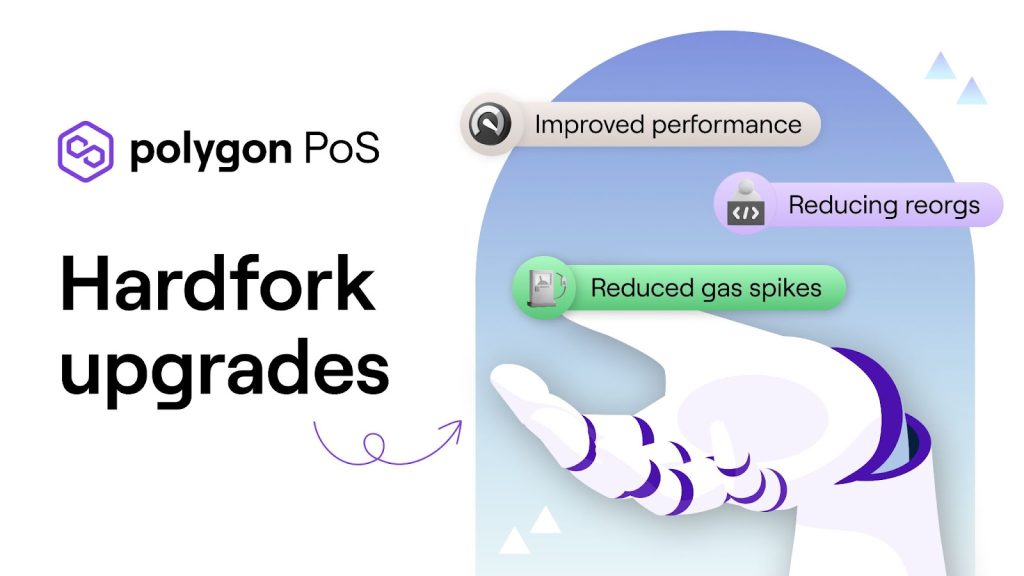

1. Polygon Hard Fork Completed, MATIC Price Skyrockets!

On Tuesday (17/1), the hard fork of Polygon, a layer 2 scaling solution running on top of the Ethereum blockchain, has finally completed. In case you didn’t know, a hard fork is when the majority of blockchain validators (in the case of Polygon, at least 67%) decided to switch to the new software. In essence, the process of doing this “creates a new blockchain.” Hard forks are frequently employed to make significant changes to one or more of a network’s core mechanisms.

There are two things about Polygon that they wish to change. The first modification concerned how they determined gas prices. Polygon wants to lessen the price spikes for gas that frequently happen during periods of high activity in their chain. Even though the overall cryptocurrency market boom has temporarily paused, the MATIC token has increased 14.12% over the past seven days and 1.4% over the past 24 hours.

The Polygon PoS network has been upgraded ???

— Polygon (@0xPolygon) January 17, 2023

To learn more about the upgrade, check out ?https://t.co/RaBWDjEGrI pic.twitter.com/WiDOdJWzaK

2. Bitcoin Briefly Taps $21k as Crypto Market Cap Reclaims $1T

The beginning of 2023 seems to provide fresh air for the crypto market. Earlier this year, for the first time since the FTX catastrophe in November 2022, Bitcoin (BTC) was able to trade beyond the US$20,000 mark. The price of Bitcoin (BTC) has risen by 25.9% over the last 14 days. Meanwhile, if we measure the last 24 hours, the crypto asset with the largest market capitalization has strengthened 11%, to exceed the US$20,000 level. Bitcoin was even observed to be trading slightly above the US$21,000 range at the start of today’s trading hours (14/1).

Currently, its TVL amount has touched US$90 million, which is the highest level since early November. However, this number is still smaller than the Ethereum network or BNB Chain. But recently, Cardano has managed to outpace their growth. This positive sentiment is also reflected in the global crypto asset market capitalization, which has exceeded US$1 trillion. Over the past 24 hours, the crypto market cap has increased by around 9%.

3. USDT 2022 Settlement Volume Blows Past Visa and Mastercard

According to a tweet on January 14th, in the year 2022, the stablecoin Tether USD (USDT) has processed US$18.2 trillion worth of transactions. This amount puts USDT ahead of traditional payment processing companies such as Visa and Mastercard. In comparison, Mastercard and Visa processed US$14.1 trillion and US$7.7 trillion worth of transactions, respectively.

Tether’s high transaction volume proves that over the past few years, the stablecoin asset class has managed to carve out massive growth. Regardless of the tough challenges that are still facing the crypto industry, stablecoins seem to be growing rapidly. In addition, stablecoin adoption rates are also growing in countries that are forcing their economic conditions to put their national fiat currencies at a current disadvantage.

4. Iran and Russia to Issue Gold-backed Stablecoin

Iran’s central bank is reportedly working with the Russian government to co-launch a gold-backed stablecoin. The two will create a crypto token for the Persian Gulf region that will serve as a payment method in foreign trade. The stablecoins tend to be a popular medium of exchange, because of the price stability they provide.

Quoting from local news agency Vedomosti on Sunday (15/1), Executive Director of the Association of Russian Crypto and Blockchain Industries (RACIB), Alexander Brazhnikov, said that the crypto token is projected to be issued in the form of a gold-backed stablecoin. The stablecoin aims to enable cross-border transactions instead of using fiat currencies such as United States dollars (USD), Russian rubles or Iranian rials. The potential crypto token will operate in a special economic zone in Astrakhan, Russia. In that region, Russia started accepting shipments of Iranian cargo.

5. Ethereum Hits Ten-Week High, Turns Deflationary Again?

Ethereum (ETH) price has surged to its highest level in the last ten weeks. In addition, ETH issuance is also returning to the deflationary area thanks to increased network demand. The closing price of Ethereum was at US$1,600 on the morning of January 16. Contributing further to its weekend gains, ETH managed to touch its highest price since November 8th, and hit US$1,589 this morning.

At the time of publication, the asset has gained 3% over the last 24 hours and is trading at US$1,568. In addition, ETH has also been noted to have gained more than 30% over the past two weeks. The bullish momentum for Ethereum itself has also been picking up just months before the Shanghai upgrade event took place. Moreover, this upgrade will later allow stakers to make gradual withdrawals on ETH balances in staking that have been stuck in Beacon Chain for more than two years.

That wraps up for Crypto This Week. We’ll see you at the next one!

Find us on Twitter, Facebook, Instagram, or join our Telegram community.

NOBI is available on both Google Play Store and App Store. Download now and create your free account in minutes!

Related Article