Crypto This Week: XRP Shows ‘One of the Cleanest Setups’ and Could Rally to US$0.68

What Happened in the Crypto Industry & NOBI During the Past Week?

Hey, NOBI’s! This week, the crypto market has been filled with various exciting events that have had a significant impact on crypto assets. XRP is regarded as having a “clean setup” and the potential for a rally to US$0.68. The maneuver by BlackRock has successfully sparked a price increase in the crypto market. The Ethereum network has also achieved success with the arrival of 30,000 “Ethscriptions” that could boost the price of ETH. Any other exciting news? Check out our special crypto news roundup of the past week!

1. XRP Shows ‘One of the Cleanest Setups’ and Could Rally to US$0.68

In the ongoing legal battle between the US Securities and Exchange Commission (SEC) and Ripple, a cryptocurrency market analyst sees the potential for a bullish rally for XRP, provided it breaks through a critical resistance level.

XRP price action analysis and prediction. Source: Mags

Interestingly, XRP is recognized as having “one of the cleanest setups so far,” and its “next target would be $0.68 or higher” if it successfully surpasses the level above $0.55, as revealed in the analysis by the crypto expert known as Mags, aka thescalpingpro, shared in a tweet on June 18.

Meanwhile, according to another crypto analyst, Altcoin Sherpa, XRP remains one of the strongest altcoins in the sector and has the potential to reach $0.8 in the near future. Additionally, hedge fund manager Thomas Kralow predicts the token could reach anywhere between $10 and $30 in the next three to four months. Factors such as “speculative narratives” and high interest in XRP within the crypto community contribute to this upward movement.

Moreover, renowned crypto trading expert Michaël van de Poppe also favors XRP, along with Litecoin (LTC), as two primary altcoins to watch in the near future. This relates to the ongoing lawsuit and its impact on XRP’s price direction.

2. Crypto Asset Prices Soar as BlackRock’s Maneuver Sparks a Rally

Cryptocurrency prices experienced an increase at the end of Friday’s trading (16/6/23) thanks to BlackRock, the world’s largest asset manager, announcing the launch of iShares Bitcoin Trust. As a result, Bitcoin rose by 3.75% and Ether by 3%. Other renowned altcoins such as Solana, Cardano, Binance Coin, Litecoin, and Uniswap also saw a significant surge in their prices.

When BlackRock #Bitcoin spot ETF?

— Jake Simmons (@realJakeSimmons) June 22, 2023

Timeline depends on the publication in the Federal Register. Assuming July 29:

August 12: Extend 45 days

September 26: Extend 90 days

December 25: Extend 60 days

Final deadline: February 23, 2024.

h/t @K33Research

More details 👇

BlackRock’s filing for a Bitcoin spot ETF has injected new life into the market and triggered a strong rally. The hope is that BlackRock will initiate a “Great Accumulation Race” around Bitcoin, considering the fact that 69% of investors have refrained from selling their Bitcoins for over a year, as reported by Bitcoinist.

Market experts believe that the BlackRock ETF has a high chance of approval. Notably, BlackRock has an approval ratio of 575:1, while the US Securities and Exchange Commission (SEC) has a clear record of rejecting Bitcoin spot ETFs: 33:0.

Due to BlackRock’s close ties with US regulators and Democratic politicians, there is room for an optimistic outlook regarding the likelihood of approval. As noted by K33 Research in their latest market analysis, BlackRock would not invest time and resources if they did not perceive the approval chances as very high.

3. New Survey Reveals 31% of Australian Youth HODL Crypto Assets

The latest research reveals a surprising fact. It turns out that almost a third of young investors in Australia hold or have traded cryptocurrencies, despite previously considering themselves “risk-averse” or cautious about taking risks.

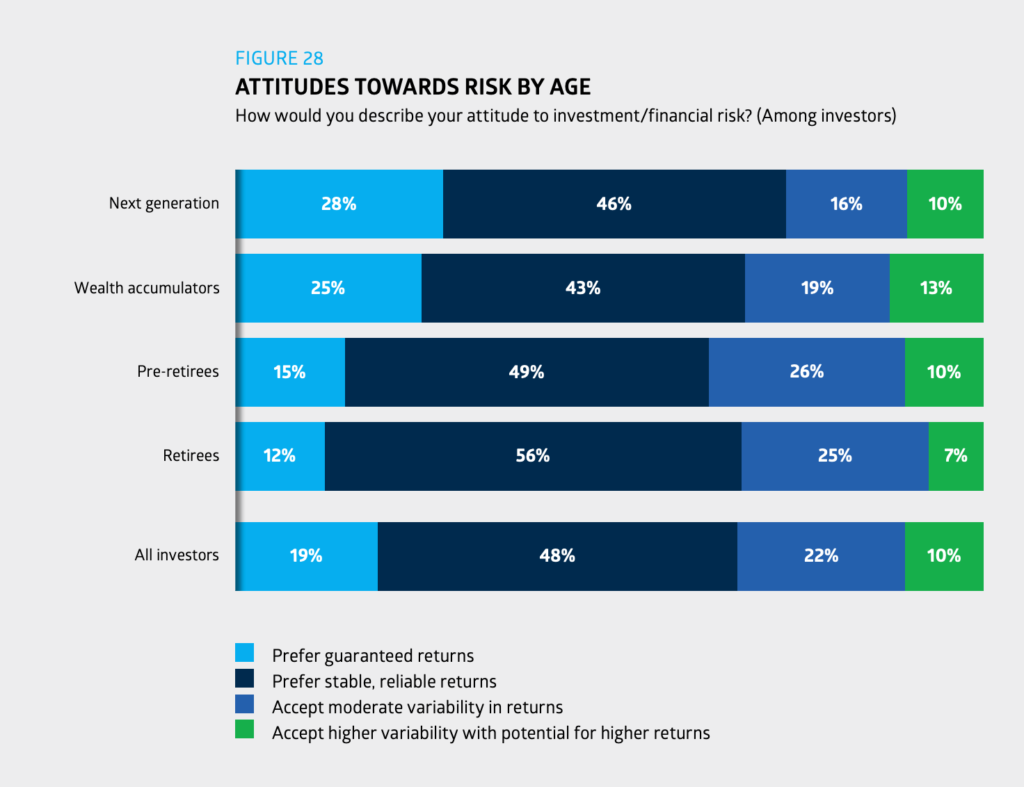

In a study conducted by the Australian Securities Exchange (ASX), 46% of the “next-generation investors” – referring to investors aged 18 to 24 – stated a preference for “stable returns.” However, what’s intriguing is that 31% of them have actually invested in cryptocurrencies.

Attitudes towards investment risk by age group. Source: ASX

Researchers suggest that the reason young investors are getting involved in crypto is their desire to differentiate themselves from their parents. The research also found that many of the 1.2 million new investors who have entered the market since 2020 are tech-savvy and connected to social media.

4. Massive Success! 30,000 “Ethscriptions” Land on the Ethereum Network, Can It Boost ETH Price?

Ethereum users now have another way to create non-fungible tokens (NFTs) and other digital assets on the blockchain with the launch of a new protocol.

Dubbed “Ethscriptions” and launched on June 17, the protocol pays homage to the Bitcoin Ordinals that has inspired many. Through Ethscriptions, users can create their digital assets more easily and in a more decentralized manner, without the need for complex smart contracts.

Tom Lehman, a co-founder of music website Genius.com who goes by the pseudonym Middlemarch on Twitter, is the brain behind this project. Lehman hailed the project as a “great success” in a series of tweets on June 17 and noted that nearly 30,000 Ethscriptions had been created within the first 18 hours since the protocol’s launch.

With almost 30k Ethscriptions in <18 hours, the launch was a huge success!

— Middlemarch.eth (@dumbnamenumbers) June 17, 2023

Thank you for seeing the massive potential here!

I am on Ethscriptions 24/7, but I need your help!

DM @proroketh to join our protocol Twitter chat. Ideas, bug reports, NO alpha, NO trading, NERDS ONLY! pic.twitter.com/udKdsVT0L8

The price of Ethereum remained relatively stable around $1,729 on Monday (June 19, 2023). However, Ethereum bulls displayed a brief but impressive performance over the weekend, causing the price of ETH to spike to $1,765. As of the time of writing, ETH has continued to rise and is hovering around the $1,880 mark. So, will the price of Ethereum soar past the $2,000 level in the near future?

5. Global X Exec: Crypto is a “Long-Term Investment” We’re Building Out Now

In a recent statement, an executive from Global X revealed that investing in crypto is a long-term play that we are currently building. According to the executive, the development of blockchain use cases will play a significant role in determining the value of crypto assets in the future.

In expanding their crypto business, Global X, an ETF issuer, is taking a gradual approach that aligns with the evolving use cases of blockchain technology.

Last week, the company introduced two separately managed account (SMA) offerings based on digital assets. These SMAs can be accessed through the Eaglebrook Advisors platform, which is used by registered investment advisers (RIA). The SMAs provide responsible direct exposure to crypto assets, aiming to generate interest in long-term investment.

But it doesn’t stop there. Global X, managing $41 billion in assets across over 100 ETFs in the US, has also launched several other crypto and blockchain-related products, including the Global X Blockchain ETF (BKCH) in July 2021. Although still in the early stages, with support from major companies and the growth of the blockchain ecosystem, the future of crypto and blockchain looks bright.

That wraps up for Crypto This Week. We’ll see you at the next one!