APY & APR in Crypto: What Are the Key Differences?

When putting money into crypto assets, it’s important to have a solid understanding on the aspects of such assets. Crypto staking is one of the best ways to make money in the crypto market. By staking coins or tokens, our crypto assets can continue to grow and bear fruit by themselves over time.

But before we get there, there are a few things you should know, like the difference between the Annual Percentage Yield (APY) and the Annual Percentage Rate (APR). In this article, NOBI will review the differences between APR and APY in the crypto industry. Now, let’s take a look at the following article.

What is APY in Crypto?

Annual Percentage Yield (APY) is the rate of return you may expect to earn on your investment each year, after factoring in the effect of compound interest. Compound interest, as contrast to simple interest, is calculated on a periodic basis and added directly to the investor’s balance. Since the balance grows over time, so does the interest paid to the investors.

In crypto staking, APY is simply a handy indicator for calculating the nominal amount earned over the course of a year. So essentially, APY is a method used to calculate how interest grow over time.

Generally, asset management firms have a variety of specific return programs that are offered to crypto investors. Including, for instance, NOBI’s Earn feature. Each crypto management platform offers its own rate of interest given and charged. This means that investors need to make wise decisions in order to properly manage the funds that will be issued and earned through crypto investments.

What is APR in Crypto?

Meanwhile, the Annual Percentage Rate (APR) usually refers to the annual interest rate charged to borrowers and then paid to investors. Although APY and APR are similar at first glance, APR does not apply annual compound interest calculations like APY.

In the context of crypto assets, APR can be interpreted as the annual loan interest rate charged to the borrower of the asset to be paid to the investor of the asset. You can get APR by staking and you have to pay if you apply for a crypto loan.

The purpose of APR is so that the borrower can compare loan interest rates between one lending institution such as a bank or P2P lending with other lending institutions. The APR calculation method itself already includes all administrative costs and other costs, but does not include compound interest or compounding rates as in the APY method.

Key Differences Between APY and APR

Now we know that APR and APY are both ways to calculate interest rates. Where APY refers to the percentage rate of interest earned in a year. While APR refers to the level of credit costs that must be paid in one year. The difference lies in that, if APR calculates the interest charged to us, then APY on the other hand, is a method for calculating the interest we earn.

Well, so far the difference between the two has, up until this point, been pretty obvious and simple to grasp. Now, in order to gain a better understanding of the two, let’s go through the key differences between APY and APR.

a. The presence/absence of Compound Interest

As previously stated, the compounding effect is calculated when using the APY method but not when using the APR. All administrative costs and other charges are already taken into account in the APR calculation technique; compound interest is not included. Additionally, APY focuses more on the profit you will earn, while APR does on the amount of interest you have to pay.

b. While APY is Identical to Debit, APR is Identical to Credit.

In addition, APR is generally closely linked to credit. So, the lower the amount of the APR fee, the more profitable it will be for us as investors. While on the other hand, APY is most often associated with debit or deposit. That is, the higher the number of APY, the more profitable it is for us.

c. Interest Rate Calculation

Although they look similar, APY and APR aren’t the same thing. The way “interest” or yield is calculated differs between APR and APY. If APY uses the concept of compound interest, on the contrary, APR uses the concept of annual simple interest. For example, you have a crypto asset of 10 BTC, then stake it with an APR of 10% per year. Then after a year, your coin will be 10 BTC x (1 + 10%) = 11 BTC.

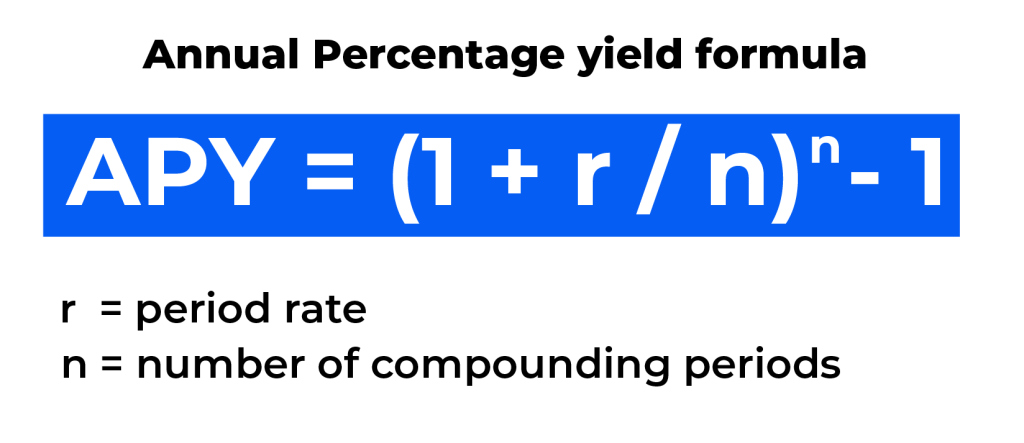

Easy Formula to Calculate Crypto APY

The following is how to calculate the APY of a crypto asset:

Description:

r = period rate

n = number of periods

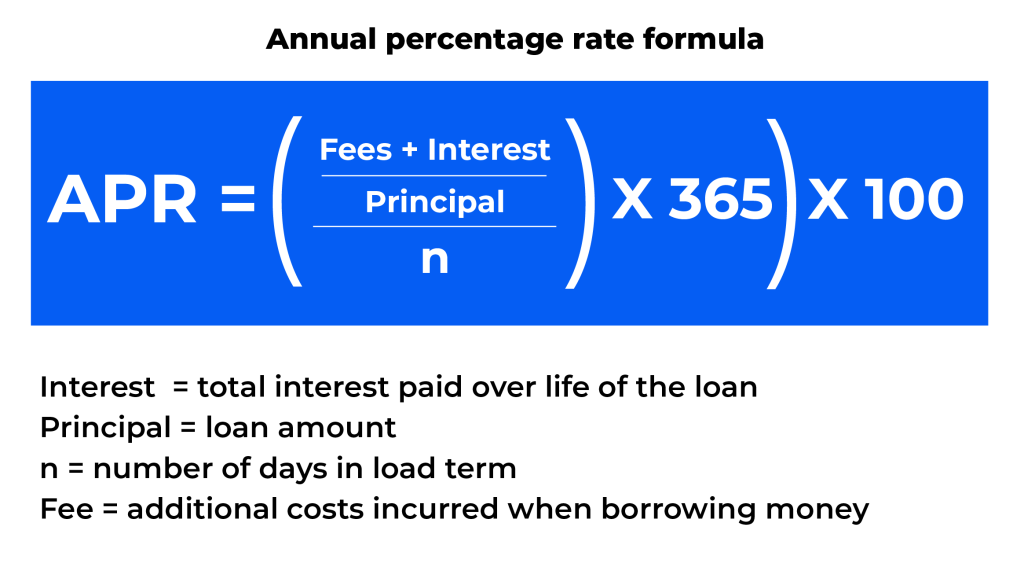

Easy Formula to Calculate Crypto APR

The following is how to calculate the APR of a crypto asset:

Description:

Interest = Total interest paid during the loan period

Principal = Loan amount

n = Number of days in load term

Fee = Additional costs charged

Closing Thoughts

Essentially, APY is a calculation to determine the standard of return or profit from an investment activity, both in traditional and crypto finance. The APY calculation adopts the concept of compound interest. The longer the investment period, the greater the interest or yield you will earn. Meanwhile, APR uses the simple interest concept. For crypto investors, it is important to compare the APY and APR offered by each crypto asset management platform in order to choose the highest interest rate to maximize profits.