Bitcoin Halving 2024: What It Means for Investors and the Future of Cryptocurrency

Introduction

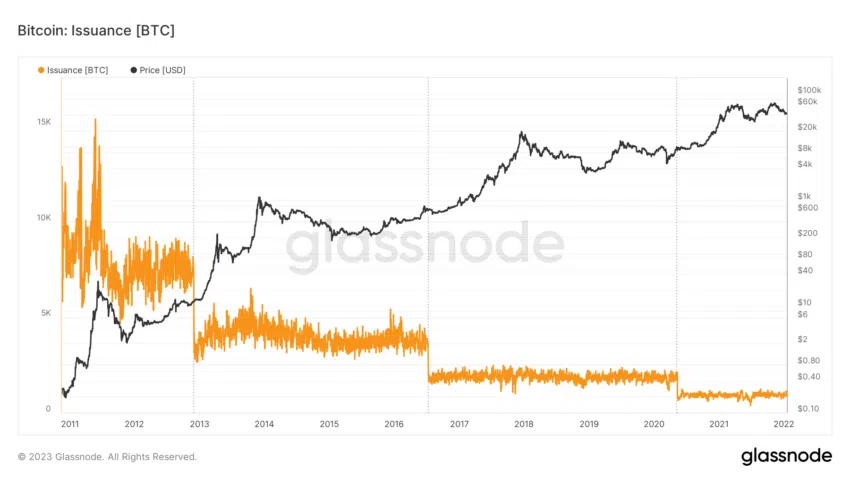

The halving is a crucial aspect of Bitcoin’s protocol, and it happens roughly every four years. It works by reducing the mining reward by half every 210,000 blocks, which has two main effects. First, it limits the inflation rate of Bitcoin and makes it more like precious metals, such as gold, in terms of scarcity. Second, it ensures that the supply of new Bitcoin entering the market is predictable and gradually decreasing.

The goal of the halving is to create an environment of deflation for Bitcoin. By limiting the rate at which new coins are created, Bitcoin’s scarcity is preserved over time, making it an attractive store of value. This makes the halving mechanism an essential component of Bitcoin’s long-term economic sustainability.

In the past, halving events have had a significant impact on Bitcoin’s price due to the limited supply of new Bitcoin. After the 2012, 2016, and 2020 halving events, the price of Bitcoin increased substantially in the months that followed, as market participants anticipated a supply shock and increased demand for the now scarcer asset.

Currently, the mining reward is set at 6.25 BTC per block, but after the next halving event in 2024, it will drop to 3.125 BTC per block. This reduction will further limit the number of new Bitcoin entering the market, potentially driving up the price as demand continues to grow amidst a decreasing supply.

Bitcoin Issuance. Source: Glassnode

However, it is important to remember that past performance does not guarantee future results. Various factors, such as market sentiment, regulatory developments, and macroeconomic trends, can affect Bitcoin’s price trajectory following the halving.

As such, market participants should approach the upcoming halving event with a balanced perspective, considering both its historical significance and the unique factors that are shaping the current market landscape.

The History of Bitcoin’s Price Performance

The upcoming halving of Bitcoin is anticipated to have a significant impact on its price, much like the previous halvings. However, it’s important to note that various other factors can also influence the outcome, including the state of the global economy, regulatory changes, and institutional investors’ strategies.

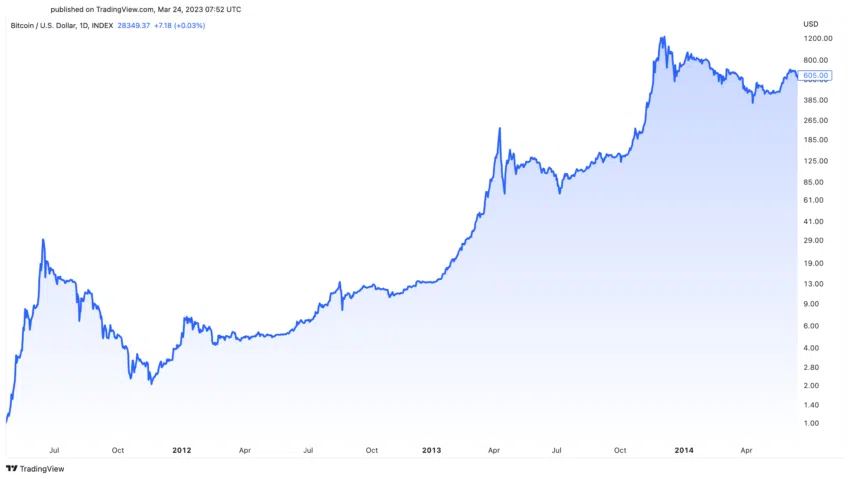

Looking back at the 2012 halving, Bitcoin’s price surged from $11 in November 2012 to an astonishing peak of around $1,100 in November 2013. This phenomenal increase occurred within just a year.

At that time, Bitcoin was still a new and unfamiliar concept, and the market was primarily driven by early adopters and retail investors who recognized the potential of a decentralized digital currency.

Bitcoin Price Performance. Source: TradingView

Following the 2016 halving, Bitcoin’s price saw a tremendous rise, going from approximately $650 in July 2016 to nearly $20,000 in December 2017. During this period, the market sentiment was predominantly bullish, driven by a surge in mainstream media coverage, the popularity of initial coin offerings (ICOs), and the entry of institutional investors into the market.

However, regulatory developments were also a significant factor during this time, contributing to market volatility and uncertainty. Crackdowns on ICOs and attempts to impose stricter regulations on crypto exchanges added an extra layer of complexity to the market landscape. Despite these challenges, the overall trend for Bitcoin remained positive, and its value continued to rise.

Bitcoin Price Performance. Source: TradingView

The 2020 halving of Bitcoin was marked by a notable increase in its price, going from approximately $9,000 in May 2020 to a staggering all-time high of around $69,000 in November 2021. During this period, institutional interest in Bitcoin also surged, with major corporations and investment funds entering the crypto market.

Furthermore, the COVID-19 pandemic had a significant impact on the market sentiment during the 2020 halving. As the global economy suffered a downturn and governments implemented unprecedented fiscal stimulus measures, concerns over inflation and currency debasement grew, leading to increased demand for Bitcoin as a digital store of value. This, in turn, further boosted its price.

Bitcoin Price Performance. Source: TradingView

Institutional investors have a significant influence on the cryptocurrency market, and their response to the halving event can greatly affect the price of Bitcoin and the broader crypto market.

The 2020 halving is an excellent example of this, as institutional investors’ growing interest in Bitcoin as a hedge against inflation and macroeconomic uncertainties played a significant role in its price increase. As more institutional investors recognized Bitcoin’s potential as a store of value, demand for the cryptocurrency rose, leading to a surge in its price.

Therefore, it’s essential to keep an eye on institutional investors’ behavior and sentiment toward Bitcoin during the halving event to better understand the potential impact on the cryptocurrency market.

The Impact on Miners

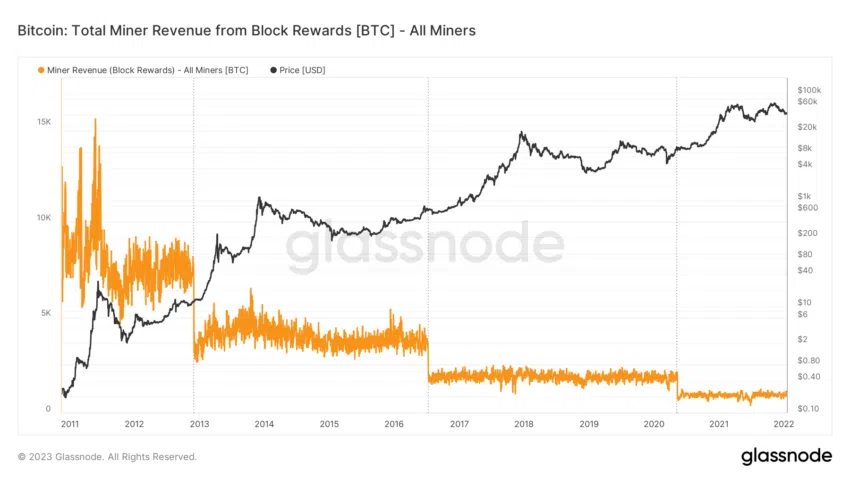

The halving event will cut mining rewards in half, which could put a substantial financial burden on Bitcoin miners. To maintain profitability and continue supporting the network, miners may need to adjust their operations.

One way miners could respond to the reduced rewards is by investing in more powerful and energy-efficient hardware to optimize their mining operations. This investment could help miners lower their energy consumption and operational costs, thereby increasing their likelihood of earning rewards by successfully mining new blocks.

Bitcoin Miner Revenue. Source: Glassnode

However, the expenses related to upgrading equipment and enhancing energy efficiency could have a more significant impact on smaller Bitcoin miners, who may not have sufficient financial resources to compete with larger, well-established mining pools.

As a result, smaller miners may face the possibility of being pushed out of the market or consolidating with larger mining operations to share resources and reduce risks.

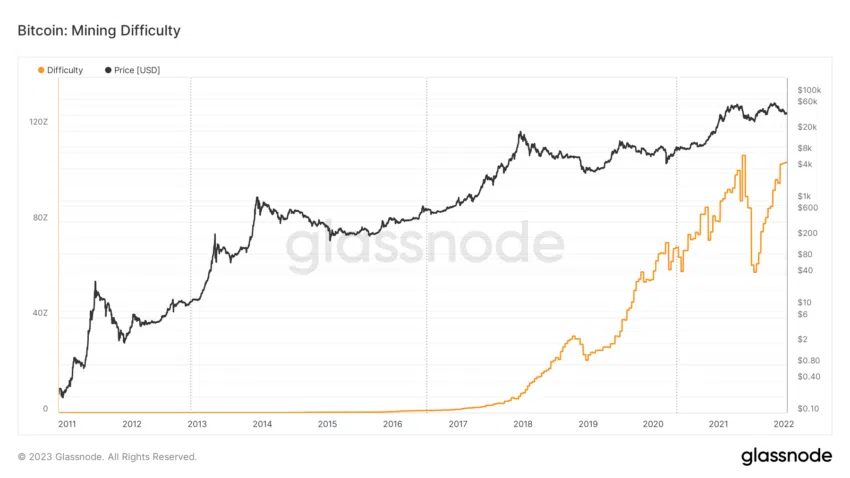

Bitcoin Mining Difficulty. Source: Glassnode

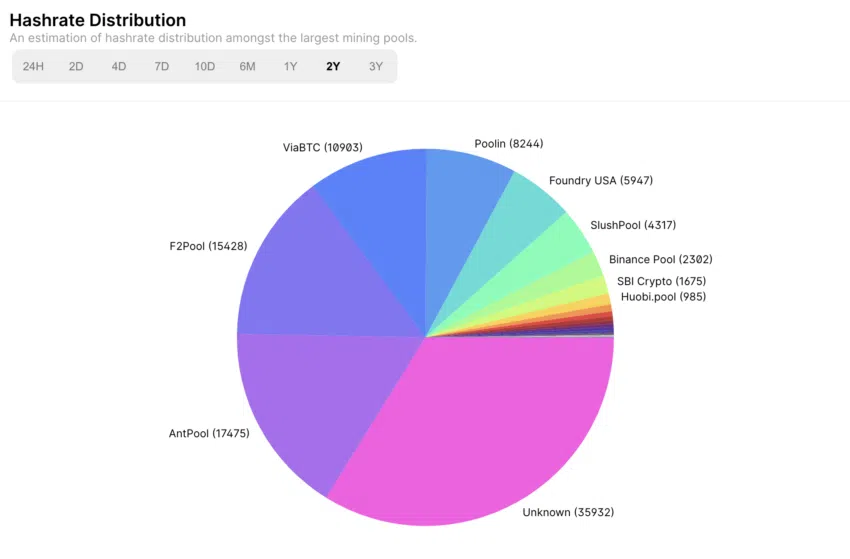

The departure of smaller miners due to the financial burden of upgrading their equipment and improving energy efficiency may result in a higher degree of mining centralization. This would mean that a few large mining pools would have more control over the network’s mining power, which poses a significant threat to the network’s security and resilience. Moreover, this could make the network more susceptible to attacks or manipulation.

Furthermore, such centralization of mining power may undermine Bitcoin’s core principle of decentralization by concentrating influence over the network in the hands of only a few entities.

Bitcoin Hashrate Distribution. Source: Blockchain.com

The upcoming halving event could bring about changes in the mining industry, as miners may begin searching for areas with lower energy costs or more favorable regulations. This could cause a shift in the geographical distribution of mining operations, which could have a significant impact on the decentralization of the Bitcoin network.

Potential Effects on the Broader Crypto Market

The Bitcoin halving event is expected to have significant implications for the broader cryptocurrency market. As mining rewards decrease, investors, miners, and users may start looking at alternative cryptocurrencies (altcoins) that offer better mining rewards, more efficient consensus mechanisms, or unique value propositions for specific use cases or industries.

This shift in focus could increase interest in and adoption of altcoins, which would impact their prices, market capitalization, and overall relevance in the cryptocurrency ecosystem. In other words, this could lead to a significant change in the cryptocurrency market, with more attention being given to altcoins.

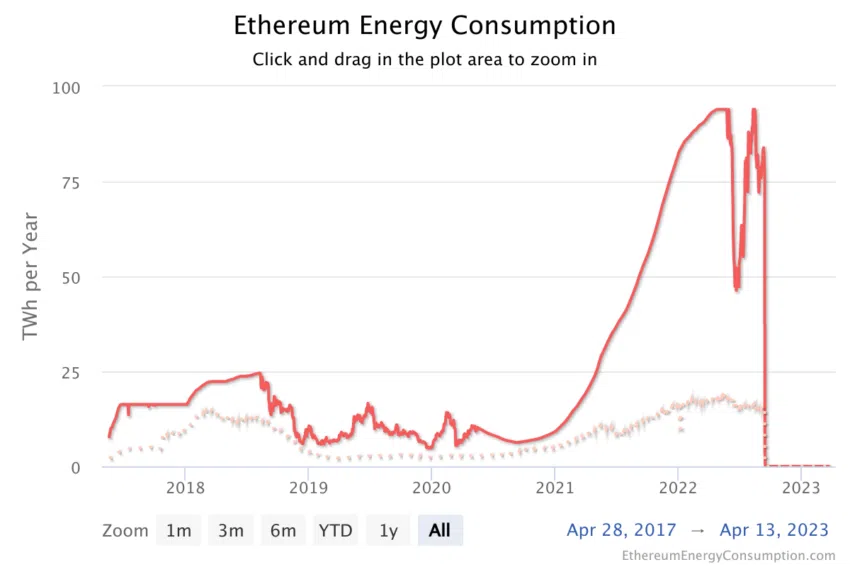

Investors may choose to diversify their portfolios by investing in cryptocurrencies that are less vulnerable to the effects of halving events. These cryptocurrencies may include those that use Proof of Stake (PoS) consensus mechanisms, which don’t rely on mining for network security and token distribution.

In other words, investors may turn to cryptocurrencies that use different consensus mechanisms to avoid the financial burden of halving events, and PoS cryptocurrencies may be an attractive option because they offer a different approach to securing the network and distributing tokens.

Ethereum Energy Consumption. Source: Digiconomist

Furthermore, the Bitcoin halving event may spark technological innovation within the blockchain industry. Developers and researchers may explore new ways to improve mining efficiency, reduce energy consumption, and enhance transaction processing capabilities.

These innovations could lead to the emergence of new consensus mechanisms, Layer-2 scaling solutions, and blockchain architectures that address the current limitations of existing networks, including Bitcoin.

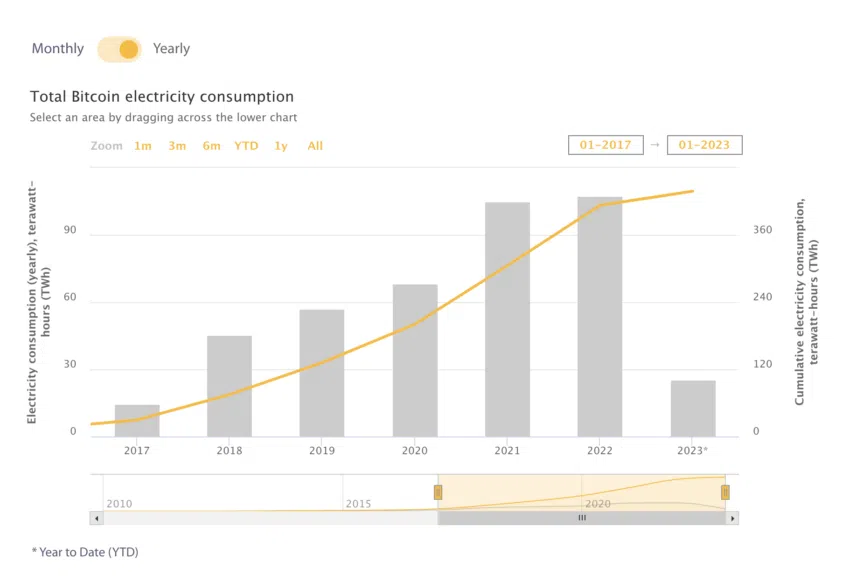

The halving event may also prompt a reevaluation of the current market dynamics. It could draw attention to the long-term sustainability of Proof of Work (PoW) networks and the environmental impact of mining operations. This scrutiny could encourage the industry to adopt more sustainable and efficient technologies. It may also incentivize the development of new solutions that balance decentralization, security, and environmental concerns.This halving event could drive the blockchain industry towards more sustainable and efficient technologies and encourage the development of new solutions to address the limitations of existing networks.

Bitcoin Electricity Consumption. Source: University of Cambridge

Moreover, the Bitcoin halving event could shake things up in terms of cryptocurrency regulations. As more people, including investors, governments, and financial institutions, pay attention to the event, it may spark discussions on how to create better guidelines for the industry. These guidelines could ensure market stability, protect investors, and comply with financial regulations.

In simpler terms, the halving event may cause people to reevaluate how cryptocurrencies are regulated and encourage them to come up with clearer guidelines that benefit everyone involved.

Conclusion

In conclusion, the Bitcoin halving event in 2024 might significantly impact Bitcoin’s price, mining operations, and the wider cryptocurrency market. While past trends suggest that the halving event may drive up the price of Bitcoin, other factors like institutional investor sentiment, regulatory changes, and macroeconomic trends could also affect the outcome. Additionally, the halving event could spark technological innovation, encourage sustainable and efficient technologies, prompt a reevaluation of cryptocurrency regulations, and lead to clearer guidelines that benefit everyone involved. Market participants should approach the upcoming halving event with a balanced perspective, taking into account both its historical significance and the unique factors shaping the current market landscape.