Crypto Fear and Greed Index — Explained

How Could the Crypto Fear and Greed Index Useful to Understand Market Sentiment?

What is the Crypto Fear and Greed Index?

In the midst of this current bear market, you will certainly hear the term Crypto Fear and Greed Index more often. But, what does the Crypto Fear and Greed Index actually mean? Let’s take a look at the simple explanation below.

In general, the Fear and Greed Index is an index that traders and investors frequently use to measure sentiment towards the market. This index consists of several types of data that can provide information regarding whether the market is bullish or bearish. This index is able to give a signal of two opposite emotions, specifically ‘fear’ and ‘greed.’

What are the Indicators / Components of the Fear and Greed Index?

The Crypto Fear and Greed Index is usually analyzed based on six indicators. These six indicators are generated from a combination of quantitative and qualitative parameters, including:

1. Volatility (25%)

This indicator will be useful for comparing the current volatility of a crypto asset and its maximum drawdown with the average values of the last 30 and 90 days. When we witness a sharp rise in volatility, it can give us a signal that the market is in a state of fear.

2. Market Momentum/Volume (25%)

Market momentum combines the current volume and market momentum of a crypto asset and compares it to the average of the last 30 and 90 days. When the upward momentum strengthens, we can use this as a signal that the market is bullish.

3. Social Media (15%)

Indicators on social media utilize sentiment analysis which is calculated from the number of uploads, replies, and hashtags from Twitter. If we see a sharp increase in interaction in a short time, we can classify the market as being in a Greedy condition.

4. Market Dominance (10%)

We can use this aspect as a measure of how much market capitalization a crypto asset has from the total share of the overall crypto asset market capitalization. The greater the dominance of the crypto asset, the less speculation there will be for other crypto assets, which may signal a bearish perspective among traders and investors.

5. Recent Trends (10%)

We can find out the trend by paying attention to Google search trends for terms related to a crypto asset. To spot trends, you need to consider search volume as well as recommendations from the most popular sites.

6. Survey (15%)

Weekly surveys are usually conducted on polling platforms to see what traders and investors think about market conditions. However, recently this survey method is rarely used as an indicator for the Fear and Greed Index.

How Does the Crypto Fear and Greed Index Work?

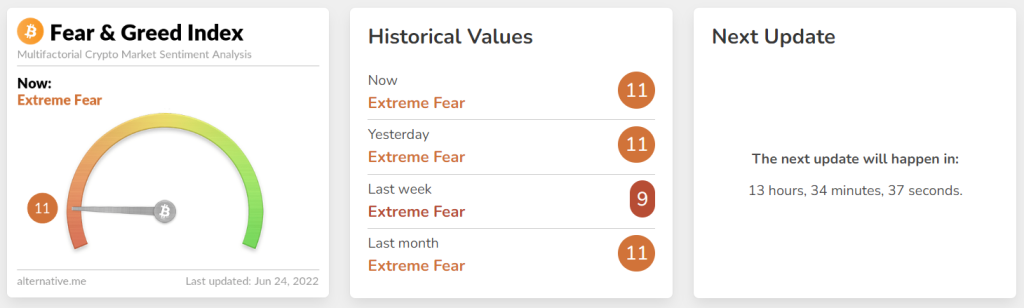

The Crypto Fear and Greed Index starts from a 0 to 100 number range. A lower score indicates that there is more fear in the market today. Meanwhile, higher scores indicate that greed is starting to haunt the market.

Next, there are several levels of Fear. Among them, there is “Extreme Fear” which is in the range of scores between 0 and 24. Then, the level of “Fear” is between the area of 25 and 49. Meanwhile, if the index is in the range of 50, we can consider it as “Neutral.” However, if the level is between 51 and 74, it indicates that there is a “Greed” in the market at the moment. Even worse, the index will experience a sharp increase to “Extreme Greed” with a score of more than 75.

Specifically, we can divide the index scale into the following categories:

- 0-24: Extreme Fear (orange)

- 25-49: Fear (amber/yellow)

- 50-74: Greed (light green)

- 75-100: Extreme Greed (green)

When the index gives an indication of Extreme Fear, many investors or traders sell and then dump prices in the market. This condition can certainly be a good buying opportunity for us, to buy crypto assets at discounted prices. When the index is at the Extreme Fear level, then FOMO or Fear of Missing Out often immediately approaches the market. Therefore, we still need to be careful in using this index as a benchmark.

Final Thoughts

Wise traders and investors usually collect supporting data before deciding whether to buy a crypto asset or choose to wait-and-see first. Charts, fundamental analysis and market sentiment are all we can learn. Where these instruments can be very useful in our process of conducting research on related assets. This research process is also popularly known as DYOR (Do Your Own Research).

However, studying a complete chart with each of the available indicators, metrics and indices, isn’t really the most efficient alternative. Because this activity can be very time-consuming. With the Crypto Fear and Greed Index, the combination of sentiment and fundamental metrics provided can give us a glimpse into the current market fear and greed. However, we also cannot rely solely on this one indicator. We can use this index to simply find out the sentiment in the cryptocurrency market in general.

The idea of the Crypto Fear and Greed Index itself is actually based on the Fear and Greed Index of the stock market, which was first initiated by CNNMoney. Where, it contains important information that we can learn about the potential for traps when profit taking versus buying and holding values.

So, does NOBI’s prefer to buy the dips, or wait and see when the Index shows the Extreme Fear signal?

NOBI is available on both Google Play Store and App Store. Download now and create your free account in minutes!