Work hard like a horse, to the point of forgetting time and family, but not yet financially free? Don’t give up so easily. Now, let’s have a look at these 7 effective ways to achieve financial freedom, according to NOBI! ️?

1. Understand Financial Conditions & Personal Needs

Sometimes, we are unaware of where our money has gone. You may also be too lazy to track tiny expenses like coffee and buying instant noodles at warkop, or to buy iced coffee at a coffee shop.

As a result, you prefer to merely think of ways so that your monthly cash can meet your living needs for one month. In fact, it’s not just about being broke or not. However, this is a helpful step in preventing us from making unwise financial decisions.

So, from now on, let us consistently monitor all money transactions on a daily basis. You must be aware of where and what you spend your money on, even if it is tiny. In fact, financial monitoring is the first step toward healthy money management. You will finally discover your personal financial situation and needs this way.

2. Build a Good Financial Plan

Are your outcome greater than your income? Some poeple may not be able to distinguish between their needs and wants. As a result, the outcome are much greater than the income.

So, if you believe you are one of those who have faced it, O lost souls, it is time for us to wake up. You need to control and distinguish between wants and needs. Moreover, the temptation of discounts as well as tempting marketing tricks can blind our eyes and finally we don’t realize that we have impulsively bought unnecessary things. So, creating a financial strategy and tracking expenses is essential for keeping our outcomes and income under control.

3. Develop a Consistent Saving Habit

There are many advantages that you get when you decide to save money early on. No doubt, saving is one of the easiest investments that anyone can make. Therefore, if you get money, always set aside some of that money for savings. Some people may view that saving is an obligation, because for them, saving is a treasure that can guarantee a life in the future.

There are many such providers that expertise in saving to financial management platforms, which will be very helpful for you to optimize consistency in saving on a regular basis. However, bear in mind that before picking on a platform, you should do thorough research first.

4. Multiple Streams of Income

If you’ve been relying entirely on one income from a single job for the past few years, it’s time to start exploring for alternative ways to enhance your income.

Simply put, you can find a side job that is lighter than your current main job. Of course, one that will not harm your professionalism in your current job.

You can explore freelance, small business at home, become a dropshipper, and so on. By adding streams of income from additional work, your total income will also increase, so you have more money to save as savings.

5. Invest in Best Low-Risk Investments

Do you know? Every year, there will be inflation (an increase in the price of goods and services in general and continuously for a certain period of time). This means that such conditions will make the value of our fiat money shrink from time to time. Worse yet, it will keep you away from your goal of achieving financial freedom. Or in other words, your salary will indeed increase over time, but can you ensure that the money you have saved will increase in value as well?

By starting to invest as early as possible, you can avoid the impact of inflation. Because your money will also work automatically, so its value will be maintained and will even increase over time. There are various types of investments that you can try, including deposits, mutual funds, stocks and even what is phenomenal today, crypto assets.

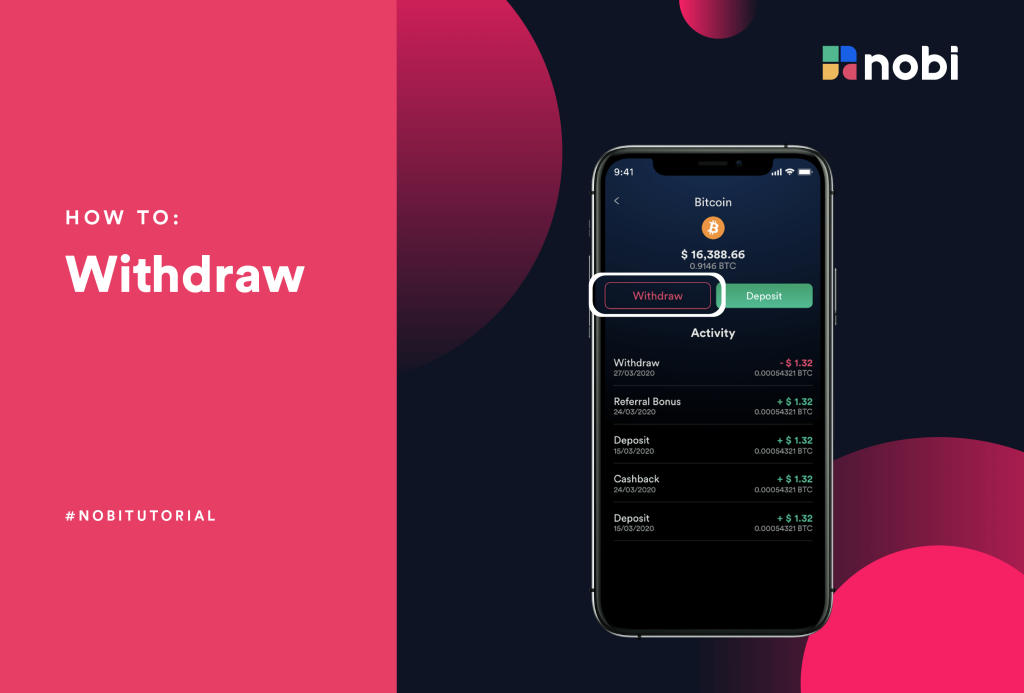

However, don’t forget to do independent research (DYOR) first before you make your choice to which crypto asset you will invest in. The easiest and safest way is to invest your money in a credible Crypto Asset Management Platform, NOBI is one of them.

6. Implement a Frugal Living Lifestyle

Simply put, frugal living is a frugal lifestyle without having to ignore the value of an item. In other words, this lifestyle concept does not mean reducing spending by buying cheap things, or even not buying anything at all, but rather using money as effectively as possible.

Despite their image for being consumptive and fond of storing unimportant stuffs, Millennials and Generation Z are beginning to embrace a minimalist lifestyle. With the adoption of frugal living, this situation gradually spread to the aspects of spending or finance. As a result, frugal living is a minimalist lifestyle idea in which you are conscious of your financial situation by focusing on your priorities.

7. Maintain a Debt-Free Lifestyle

The more debt you have, the faster your salary will disappear just to pay off debt. So, if you already have a debt, pay it off as soon as possible. But, don’t pay off debt by using a new loan, okay? In other words, don’t let you “dig a hole to close the hole”.

Then, if you’re no longer in debt, maintain track of your spending so you don’t have to go into debt again to make needs meet in the future.

So there you have it: 7 simple ways you may use in your life starting now to get you closer to your desired “Financial Freedom” goal!

Find us on Twitter, Facebook, Instagram, or join our Telegram community.

NOBI is available on both Google Play Store and App Store. Download now and create your free account in minutes!

Related Article