Crypto-Friendly Rishi Sunak to Become UK Prime Minister on Crypto This Week

What Happened in the Crypto Industry & NOBI Over The Last Week?

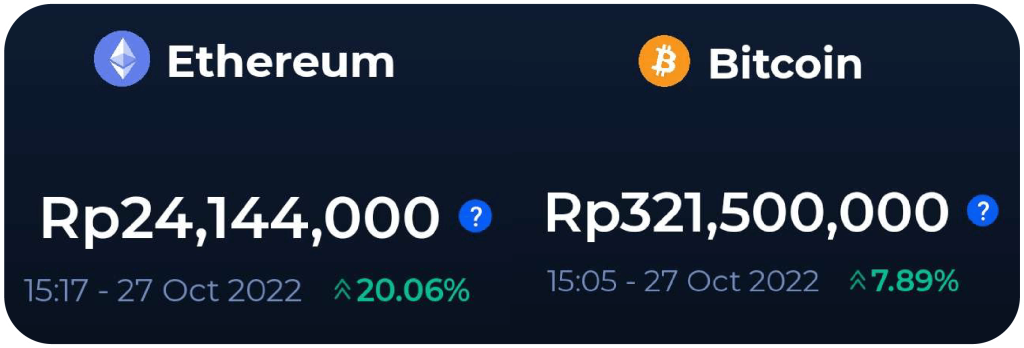

Hi NOBI’s! Time flies real fast! We’ve finally arrived at the end of October. This week, the crypto market began to recover, supported by a surge of bullish sentiment in the industry. One came from the new Prime Minister of the United Kingdom who turned out to be a crypto fan. Then, despite the fact that the world is being haunted by recession and rising inflation, the crypto market is green this week. With Ethereum rising 20% & Bitcoin soaring 7.8%! Then, what else? Let’s take a look at what’s new and interesting we have for you!

1. Crypto-Friendly Rishi Sunak to Become UK Prime Minister

Recently, Rishi Sunak was officially appointed to be the new Prime Minister of the UK. This news comes after the Liz Truss controversy broke out of office last week. In addition, Sunak is also known as a figure who led new crypto ambitions in the UK during his tenure as Minister of Finance.

During his tenure as Finance Minister under former Prime Minister Boris Johnson, Sunak announced he wanted to turn the UK into a global crypto hub. Evidence of his ambition is also reflected in his series of efforts to help regulate crypto assets in the region. Sunak contributed to ushering in the Financial Services and Markets Act, which if passed into law, could give local regulators broad powers over the crypto industry. The move could start from bringing crypto assets that are pegged to assets such as stablecoins into the sphere of payment regulations.

2. Interest in Bitcoin Surges among the Super-Rich in Hong Kong and Singapore

A survey report published by KPMG China together with Aspen Digital on October 24 entitled “Investing in Digital Assets” reveals a surprising fact. The survey results note that there are more than 90% of respondents who come from the high-net-worth individual (HNWI) segment or high-income individuals as well as from high-income family offices in Hong Kong and Singapore who are interested in investing in the digital asset sector. Even according to information, some of them have started investing in crypto.

Reporting from Cointelegraph on Wednesday (10/26/2022), the survey was conducted in 30 family offices and HNWIs in Hong Kong and Singapore that manage assets between US$10-500 million. The 90% of the total respondents were divided into two parts, with 58% of family offices and HNWIs having invested in digital assets, and another 34% planning to invest in digital assets.

3. Crypto Prices This Week: Ethereum Soars 20% & Bitcoin Soars 7.8%!

The crypto market has gone green this week, defying the bear market and the global recession fear that has gripped the world. The finest crypto assets at NOBI Trade are likewise shimmering. Bitcoin and Ethereum lead the price increases during the last week, with gains of 7.89% and 20.06%, respectively!

Data from NOBI’s top gainers in the past week also shows that there is a simultaneous increase among a number of crypto assets listed on NOBI. Besides BTC and ETH, there was also BNB which rose 7.19%, HNST which rose 10.74%, and UNI which skyrocketed to 9.89% this week. Meanwhile, slowly but surely, the price performance of FIRO and DASH looks happy with an increase of up to 2.68% and 4.55%, respectively.

4. Despite Xi Jinping’s Ban, China Remains The World’s Largest Crypto Market

Recent reports reveal that China has has preserved its position as the largest crypto market in East Asia in terms of transaction volume. At the same time, China achieved the fourth position in the world in the same category. This arises despite the fact that China has entirely prohibited the usage of crypto assets in the country for the past few years.

According to Chainalysis, total transactions in China reached more than US$220 billion between June 2021 and July 2022. In the same time period, it outperformed its neighbors South Korea and Japan.

5. Indonesia’s Central Bank Raised Its Policy Rate by 50 bps to 4.75%! What’s the Impact on the Crypto Market?

In October 2022, Indonesia’s central bank (BI), hiked the benchmark 7-day reverse repurchase rate by 50 basis points (bps). However, it is still a question mark regarding whether the increase in the interest rate will have a positive or negative impact on all crypto investors in Indonesia.

Reporting from CNN Indonesia, the impact of the increase in BI interest rates will make mortgage and business costs high, credit disbursement collapse, and the growth of the real sector will be hampered. In addition, this action will reportedly also result in fewer new job opportunities. Fortunately, this increase allegedly won’t impact the price of crypto assets such as an increase in US interest rates. The reason is, one of the strong influences on the market is still dominated by the economic policies of the US.

That wraps up for Crypto This Week. We’ll see you at the next one!

Find us on Twitter, Facebook, Instagram, or join our Telegram community.

NOBI is available on both Google Play Store and App Store. Download now and create your free account in minutes!