Crypto This Week: Tether Gaining Strength as Market Cap Nears All-Time High

What Happened in the Crypto Industry & NOBI During the Past Week?

Hi, NOBI’s! Last week, Tether’s market capitalization came close to reaching its all-time high (ATH). In just two weeks, over 440,000 Ethereum were added to liquid staking derivatives. There is a bullish pattern forming on the SUI chart, which has the potential to push the price up by 16%. Is now the right time to buy? Check out our special crypto news roundup of the past week!

1. Tether Gaining Strength as Market Cap Nears All-Time High

Tether, the largest stablecoin in the world by market capitalization, is on the verge of reaching its all-time high. With a current value of approximately $82.84 billion, Tether needs just an additional $433 million to surpass its previous record set on May 8, 2022.

As of May 13, 2023, Tether’s market valuation is estimated at $82.797 billion, indicating a 2.7% increase in the past 30 days. In contrast, Tether’s competitors such as USDC, BUSD, and DAI have experienced a decline in supply. Moreover, Tether has emerged as the dominant player in the stablecoin market, contributing around 7.09% to the total crypto economy valued at $1.16 trillion.

Tether market valuation as of May 13, 2023, according to statistics coingecko.com.

2. Rapid Growth! Over 440,000 Ethereum Added to Liquid Staking Derivatives in 2 Weeks

In less than two weeks, the total value locked (TVL) in liquid staking derivatives has increased by 441,110 ether, worth approximately $793 million. Lido Finance dominates the market with 74.35% of the TVL, while Rocket Pool and Frax Ether have experienced double-digit growth of 34% to 42% in the past 30 days.

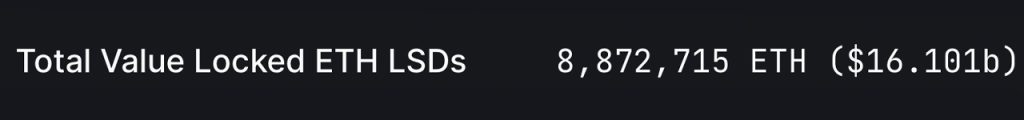

The number of Ethereum locked in liquid staking derivatives is nearing the 9 million mark. As of May 12, 2023, the TVL in liquid staking derivatives stands at 8,872,715 ether, equivalent to $16.101 billion. However, despite the recent addition of 441,110 ethereum, the TVL in LSDs is currently lower compared to April 30 due to the decline in ETH’s value. Back then, the TVL reached $16.139 billion, making today’s numbers reflect a 0.235% loss, amounting to $16.101 billion.

Statistics by defillama.com

3. New Bullish Pattern Emerges on SUI Chart, Potential 16% Price Increase: Is It Time to Buy?

Latest price analysis of SUI reveals a potential 16% price increase following the emergence of a new bullish pattern. SUI has found strong support at the $1.02 level and has successfully rebounded twice within a week. If there is a breakout above the $1.26 resistance level, the double-bottom pattern can be confirmed, indicating a potential price increase of 16.5% towards $1.47. However, it should be noted that a drop below the $1.2 support level could invalidate this bullish scenario.

Technical analysis shows bullish recovery indications, such as significant RSI recovery and strong bullish momentum reflected by the Bollinger Bands. With the current spot price around $1.23 and the evident bullish trend, SUI presents an attractive potential for price appreciation for investors. Nonetheless, investors should closely monitor price movements and exercise caution regarding potential declines below the support level that could negate the bullish scenario.

4. Bitcoin Shows Positive Signs as Analysts Maintain US$40K BTC Price Target

On May 15, Bitcoin reached its highest level in the past five days at US$27,666 after the Wall Street opening. In a stagnant US stock market, crypto analysts sought clues about the market’s direction. According to Michaël van de Poppe, the founder and CEO of Eight, the outlook is positive. He concluded, “Bitcoin is moving upward and testing US$27,600. Good signs. On the weekly timeframe, we will continue towards US$38,000-42,000 from here.”

Analysts remain optimistic about Bitcoin’s price and believe that the US$40,000 level still holds potential as a magnet. Despite several positive signals, volatility in BTC/USD remains under control. Additionally, attention remains focused on the strength of the US dollar and its influence on the crypto market. Well-known traders like Michaël van de Poppe and Kaleo have provided positive analysis regarding Bitcoin’s price movement.

5. Apple is Set to Release Highly-Anticipated Mixed-Reality Headset, Are Metaverse Tokens Ready to Skyrocket?

Apple is set to release its long-awaited mixed-reality headset, a groundbreaking move that is believed by some to bring a new wave of excitement to the metaverse industry. In fact, metaverse tokens like Decentraland (MANA) and Sandbox (SAND) have already experienced significant price increases earlier this year, partly fueled by rumors of Apple’s venture into mixed reality.

This trend was also highlighted in a tweet on May 15 by independent developer Udi Wertheimer, who mentioned that the release of the new headset could act as a catalyst for the rise in metaverse token prices.

CT is completely oblivious to the fact that Apple is about to launch a mixed reality headset in 3 weeks

— Udi Wertheimer (@udiWertheimer) May 15, 2023

Metaverse shitcoins are going to pump so hard it’s not even funny

But you morons keep buying influencer coins

Ok

However, other analysts believe that the performance of metaverse tokens will heavily depend on the widespread adoption of the metaverse by everyday users. Nevertheless, we are still in the early stages of metaverse development, and the performance of metaverse tokens will largely rely on their popularity and adoption in the future.

That wraps up for Crypto This Week. We’ll see you at the next one!