Gold vs. Bitcoin

Since its inception in 2009 by the anonymous creator Satoshi Nakomoto, Bitcoin has experienced a remarkable surge in value, capturing global attention. Its market capitalization surpassed US$1 trillion in April 2021, attracting the interest of many investors who are now comparing Bitcoin to gold as a store of value.

Traditionally, investors and traders have relied on assets such as real estate, stocks, bonds, and gold to preserve their wealth. Gold, in particular, has been regarded as a reliable hedge against inflation over long periods of time. However, digital currencies have emerged as a new type of asset that is increasingly seen as both a store of value and a medium of exchange for everyday transactions. In this context, Bitcoin has earned the moniker of “digital gold.”

What is a Store of Value?

A store of value is an asset that maintains its worth over time and can be easily stored and retrieved. In contrast to fiat money, which tends to lose value over time due to inflation, assets like stocks, bonds, and real estate are often chosen as investments to preserve and potentially grow wealth. However, these investments are subject to market fluctuations and can be correlated, meaning they may all be affected by similar market conditions.

This is where the debate between Bitcoin and gold as stores of value arises. Gold has been a reliable store of value for thousands of years, surviving the rise and fall of various monetary systems. It is often seen as a safe haven asset, retaining its value during times of market turbulence. On the other hand, Bitcoin has emerged as a decentralized digital asset that offers durability, scarcity, and the potential for privacy and security.

Why is Gold a Popular Store of Value?

Gold has a long history of being valued for its unique properties, such as its resistance to oxidation and versatility for creating coins and jewelry. It has been used as a medium of exchange and a way to preserve wealth across generations. However, the gold standard monetary system, where the value of paper money is backed by gold, has become less prevalent over time.

Why is Bitcoin a Store of Value?

Bitcoin, on the other hand, is a relatively new digital asset that operates independently of central banks and governments. It has a limited supply of 21 million coins, providing scarcity similar to gold. Bitcoin’s decentralized nature and transparency through blockchain technology have contributed to its growing acceptance as a means of exchange and store of value.

Both gold and Bitcoin have characteristics that make them attractive as stores of value. Gold is physically tangible and has a long-standing reputation for stability, while Bitcoin offers portability, divisibility, and potential privacy advantages. Ultimately, the choice between Bitcoin and gold as a store of value depends on individual preferences and risk tolerance.

A Glimpse into the Past: Stability and Tradition of Gold

Gold has stood the test of time as a trusted store of value, symbolizing wealth, strength, and stability throughout history. With a track record spanning centuries, this precious metal has endured various economic upheavals, from the fall of ancient civilizations to modern financial crises, consistently preserving its value over generations.

Inflation Hedge and Tangibility

One of the notable advantages of gold is its role as a hedge against inflation. While fiat currencies may experience a decline in purchasing power due to inflation, gold has often demonstrated resilience and even appreciation in value during such periods. This has made it an attractive choice for investors seeking to safeguard their wealth from the erosion caused by inflation.

Furthermore, gold’s physical nature provides a sense of security and tangibility that digital assets lack. This appeal to the tangible aspect of wealth appeals to individuals who value the tactile experience and presence of physical assets.

Challenges and Considerations

However, it is important to acknowledge that gold does come with its own set of challenges. Secure storage and transportation of gold can be both expensive and logistically complex, particularly when dealing with significant quantities. The occurrence of high-profile heists, like the infamous Brink’s-Mat robbery in London in 1983, where thieves stole gold worth £26 million, serves as a reminder of the risks associated with the storage and transportation of this precious metal.

Is Bitcoin a Wiser Investment Choice than Gold?

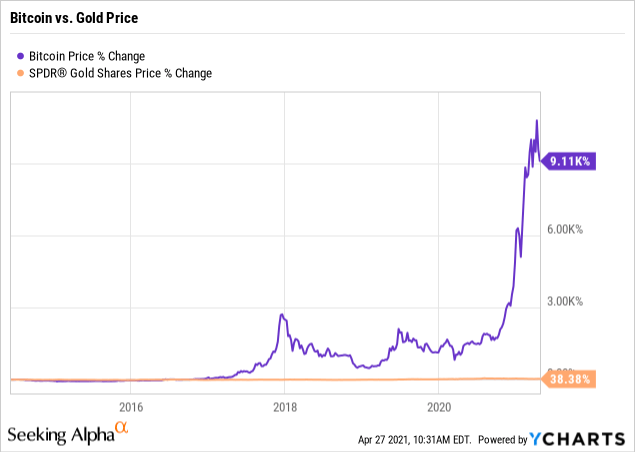

In the last decade, Bitcoin has proven itself to be a highly successful investment, regarded as a groundbreaking technological advancement. Meanwhile, gold investors have experienced relatively modest returns during the same period, partly influenced by the already high price of gold. However, it’s crucial for investors to focus on the present and future rather than becoming fixated on past trends.

Data by YCharts

Bitcoin is considered a momentum investment, while gold is seen as more of a value investment currently. Research suggests that a combination of value and momentum assets can lead to favorable long-term returns, as these investment styles exhibit positive performance with negative correlation to each other. Therefore, owning both Bitcoin and gold can offer greater benefits than holding either asset individually.

Volatility is an important factor to consider, and it differs between gold and Bitcoin. Gold has historically shown volatility levels similar to stocks but serves as a reliable hedge during times of crisis, with an average annual volatility of around 16 percent. On the other hand, Bitcoin is known for its higher volatility. By estimating annual volatility based on its daily volatility, Bitcoin’s annual volatility is approximately 40 percent, making it 2 to 3 times more volatile than gold.

Conservative investors who are concerned about Bitcoin’s volatility can still include it in their portfolios by adjusting their position sizes based on their risk tolerance. By allocating a smaller percentage of their portfolio to Bitcoin, conservative investors can participate in its potential upside while managing the impact of its volatility.

For example, allocating around 3 percent to Bitcoin and 7 percent to gold can provide a balanced approach for conservative investors. This strategy allows them to capitalize on Bitcoin’s growth potential while relying on the stability of gold as a store of value. The key takeaway is that conservative investors should not overlook Bitcoin’s potential due to its volatility, but rather adjust their portfolio allocation that suits their risk tolerance and long-term goals.

The Thesis of “Digital Gold” is Being Proven Right

Gold has long been considered a comparable asset to Bitcoin, and its status as a digital store of value has been a key feature. Governments worldwide have implemented stricter financial controls for various reasons, which could further highlight the advantages of cryptocurrencies, such as self-sovereignty and decentralization.

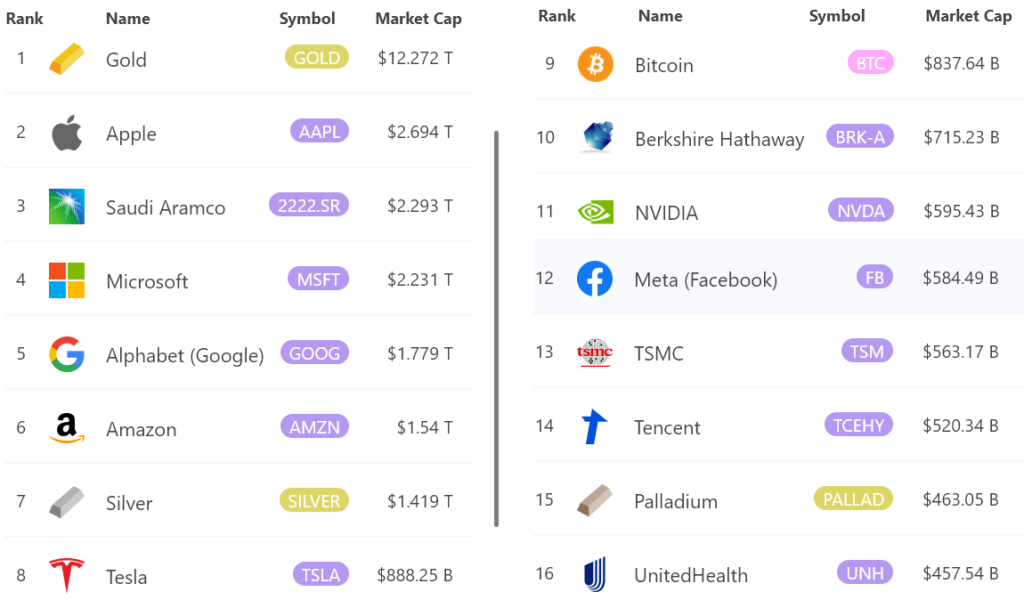

Most valuable tradable global assets. Source: 8marketcap.com

Bitcoin, often referred to as the “digital gold,” shares similarities with gold as a store of value and medium of exchange. However, there are notable differences between the two.

While gold has the additional use case of being used in jewelry, its physical nature poses challenges in terms of storage and transfer. On the other hand, Bitcoin can be transferred quickly and efficiently due to its digital nature, eliminating the need for third-party involvement in transactions.

Another distinction is the verification process. Verifying the authenticity of a gold bar requires expertise, while verifying Bitcoin transactions can be done easily through online platforms.

Given these factors, many in the community believe that the eventual shift towards Bitcoin as a preferred medium of exchange is inevitable.

Similarities between Bitcoin and Gold

| Liquidity Both Bitcoin and gold have liquid markets where they can be exchanged for fiat money. |

| Divisibility Both assets are divisible into smaller quantities. |

| Scarcity Both Bitcoin and gold have limited supplies, making them effective hedges against inflation. |

| Correlation with other financial markets Both Bitcoin and gold offer a hedge against equities due to their low correlation with the stock market. |

| No interest Neither Bitcoin nor gold pays interest, but their value can be compared to the opportunity cost of holding cash. |

| Retrieval method Both Bitcoin and gold are obtained through mining, in contrast to freely printed paper currency. |

Differences between Bitcoin and Gold

| Bitcoin | Gold | |

|---|---|---|

| Intrinsic value | Bitcoin has no intrinsic value, its value is dependent on market forces. | Gold has historically been used as jewelry or for industrial applications. |

| Scarcity | Bitcoin’s supply is halved every four years and is capped at 21 million. | Gold is being mined every year. |

| Security & control | Bitcoin is decentralized and not controlled by any entity, including the government. | Gold relies on banks and custodians for security. |

| Storage | Bitcoin does not require physical storage or insurance, saving investors from associated costs. | Gold is a physical asset, and holding it entails continuous costs such as storage, maintenance, and security. |

| Transport | Bitcoin is highly portable and can be sent and received quickly with minimal friction, as long as the user has access to their private keys. | Gold requires physical transportation across cities, states, countries, and continents, which can be costly, time-consuming, and logistically challenging. |

| Market value | The total market value of Bitcoin is smaller compared to that of gold. | The total market value of gold’s supply is greater than that of Bitcoin |

| Volatility | Bitcoin is known for its higher volatility compared to gold | Gold is less volatile compared to Bitcoin across daily, weekly, and yearly timeframes. |

Conclusion

Both Bitcoin and gold serve as a hedge against a weakening US dollar. However, it’s important to consider their different characteristics. Gold, with its long-standing history, continues to be a reliable store of wealth and a trusted safe haven in times of instability. In contrast, Bitcoin is a newcomer in the market, offering improved qualities like limited supply, divisibility, and seamless transferability. These advancements position Bitcoin as a more appealing choice for preserving value when comparing it to gold.

Bitcoin takes the crown as an enticing investment choice, thanks to its impressive track record of remarkable returns. This “crypto king” has shown significant potential for substantial gains, coupled with a relatively lower risk profile. On the other hand, gold follows a more traditional risk-reward balance, potentially limiting its potential for exponential growth compared to Bitcoin. If you find either of these assets appealing, diversifying your investment portfolio by owning both could be a wise move.