There are more and more layer-1 blockchain technologies that are being deployed recently, most of these layer-1 projects are addressing the crypto trilemma problems, which is decentralization, security, and scalability. Most layer-1 projects are capable of solving only two aspects of this trilemma. Take example of Bitcoin and Ethereum which have strong decentralization and security, while lack of scalability, these two projects required the layer-2 technologies existence in order to solve its scalability issues.

On the other hand, projects such as Ripple and BNB Chain have strong security and scalability, both networks are fast. However it is sacrificing the decentralization aspect as both networks are mostly being controlled by a single entity or company.

What if? There is one crypto layer-1 blockchain project that tries to solve all the trilemmas (decentralization – security – scalability)? Will this project achieve their goals within the crypto industries?

This is where Algorand comes in as newer generations of layer-1 blockchain projects which focusing its technology to address the classic crypto trilemma.

Introduction

The common limitations of crypto blockchain projects are scalability. The moments where blockchain projects attract investors and users, its network will become busy with transaction requests. Since blockchain are processing sequential blocks of data, each data needs to be verified and processed one by one in sequence order. This creates a slow down on the network when network traffic is congested.

Take an example of the Ethereum blockchain. While every block is verified every 12 to 14 seconds, each block can only hold 80 to 130 transactions per block. Meaning that Ethereum networks are able to process 6 to 9 transactions per seconds. While this scalability is normal for layer-1 blockchain projects, it is still lagging behind traditional banking payment processors. Visa services, in theory, can process up to 24.000 transactions per seconds.

While layer-1 blockchain aims to provide decentralized banking and transactions systems, its scalability still becomes its major drawback. To address this issue, Algorand is being developed to accelerate the blockchain transactions speed and reduce the required time in order to process transaction blocks.

While doing this, Algorand also aims to expand the use cases of the blockchain technology. But what is Algorand exactly? Why are the developers so confident that they are able to solve the trilemmas? How does Algorand work in order to achieve such high throughput blockchain speed? We will cover it in this article.

How Does Algorand Work?

Algorand utilizes an open-source blockchain code, meaning that any developers can propose contributions to the network. Algorand are using the pure proof-of-stake (PPoS) consensus mechanism, which allows the network to choose validators from the pool of users. This mechanism randomly selects a group of token holders, called a committee, which is responsible as the network validators and confirming transactions. This committee is continuously selected randomly in each round, to ensure the decentralization and security of the Algorand network.

Algorand utilizes the Byzantine Fault Tolerant (BFT) concept for its transaction processing and block generation mechanism. This allows the Algorand network to function normally as long as the majority (2/3) of validators behave honestly. As a result, the majority of validators are discouraged from misbehaving since it will reduce the value of their assets and ensure that a small minority of bad actors cannot manipulate or harm the network.

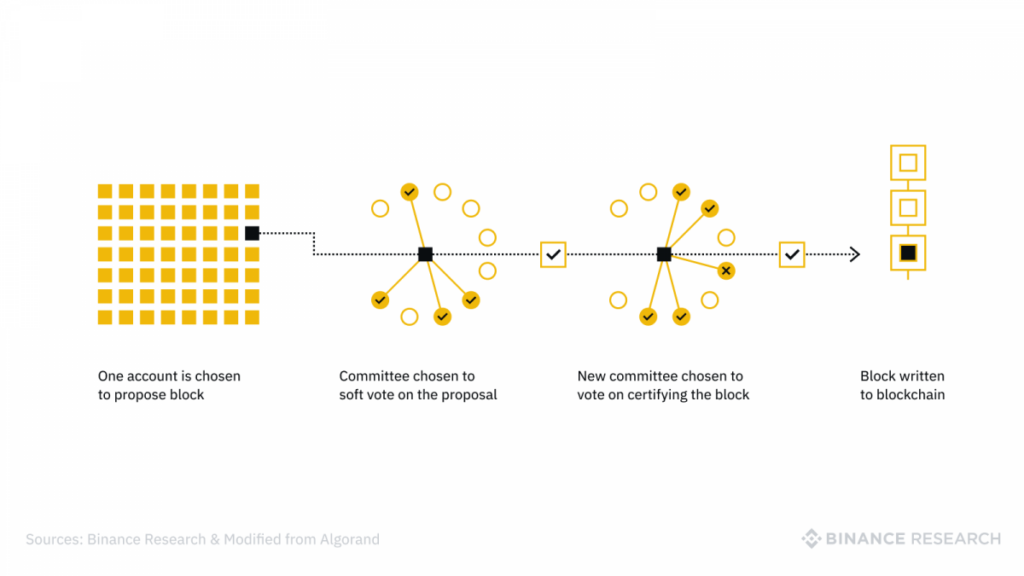

The Algorand network processes transactions in two stages:

1. Block Proposal

In Algorand, every online user who holds the ALGO token can participate in the consensus protocol. A user who wishes to participate in the protocol consensus, then generates and registers a participation key. With this key, a user can participate in proposing and voting on new blocks.

After the new block proposal, the validator of each transaction block is chosen randomly. Every block in Algorand reveals a new random seed that determines which users should participate in the next round of the consensus protocol.

Every network participant is aware of this random seed, however each validator node then checks the secret participation key using Verifiable Random Function (VRF) and the random degenerated seed to see if they were selected or not. The VRF computation produces a pseudorandom output with a cryptographic proof that anyone can use to verify the result.

2. Voting Session

The voting session requires three steps to propose, confirm, and write a block to the blockchain:

- Soft vote

After the block proposal, then each node will check if their account has been selected to participate in the soft vote committee. If an account is chosen, it will have a voting power based on the number of tokens it holds. Each selected account will choose the best block proposal by voting to confirm it. Once enough votes are gathered for the soft vote, the process moves to the certify vote step.

- Certify vote

After the soft vote phase, a new committee is chosen to examine the block proposal that received the most votes. The committee’s task is to ensure there are no issues like overspending or double-spending in the proposed block. If the block is deemed valid, the committee votes once again to certify it. Each node rechecks its managed accounts to select committee members and sends their votes. The votes are collected and verified by each node until enough votes are gathered to reach a quorum. This signals the end of the round, prompting the node to create a certificate for the block and add it to the blockchain.

After this point, a new round of block proposals, soft vote and certify vote is reinitiated and the process starts over for the next blocks.

In order to break the crypto trilema problems, Algorand utilizes many features that are incorporated with decentralization, security and scalability.

For decentralization, Algorand uses a pure proof-of-stake consensus mechanism which chooses validators randomly, not based on stake or computational powers. To participate in Algorand consensus, users only need 1 ALGO tokens, and a simple computational device such as Raspberry Pi.

For security, Algorand utilizes the Byzantine Fault Tolerant (BFT) consensus method, which slash any misbehaved validator’s rewards in order to discourage the malicious actors to come into play. The participants of each block’s round are also changing, meaning that the malicious actors do not have the information of when their turn to secure the network in order to disturb the network.

For scalability, Algorand required only a small group of users to propose, vote and validate each block, which accelerated the block time and shortened the transaction finality process. Algorand blockchain’s architecture is also designed to be scalable thanks to its Verifiable Random Functions (VRF) for secure and efficient user selection, and the use of compact certificates for fast and secure confirmation of block validity.

Algorand blockchain’s architecture functions similarly to the Ethereum network. Algorand layer-1 smart contract can process transactions normally, while the layer-2 contains an off-chain contract similar to a side chain technology. This layer-2 can process more complex applications that require stronger computing power.

Who Created Algorand?

The Algorand platform and the developer’s company were founded in 2017 by Silvio Micali, a professor at the Massachusetts Institute of Technology (MIT) and noted cryptographer.

Silvio Micali has been on the faculty at MIT, Electrical Engineering and Computer Science Department, since 1983. Silvio has received his Laurea in Mathematics from the University of Rome, and his PhD in Computer Science from the University of California at Berkeley. Silvio’s research interests are cryptography, zero knowledge, pseudorandom generation, secure protocols, and mechanism design and blockchain.

The ALGO Token

Algorand network has their own native cryptocurrency named ALGO. ALGO serves as an important component in the Algorand ecosystem as it is required for the block generation proposal and votes.

Currently there are 7,2 billion Algo tokens in circulation which valued more than $800 million in valuation. Algo sits on the top 40 of cryptocurrencies with the largest market cap.

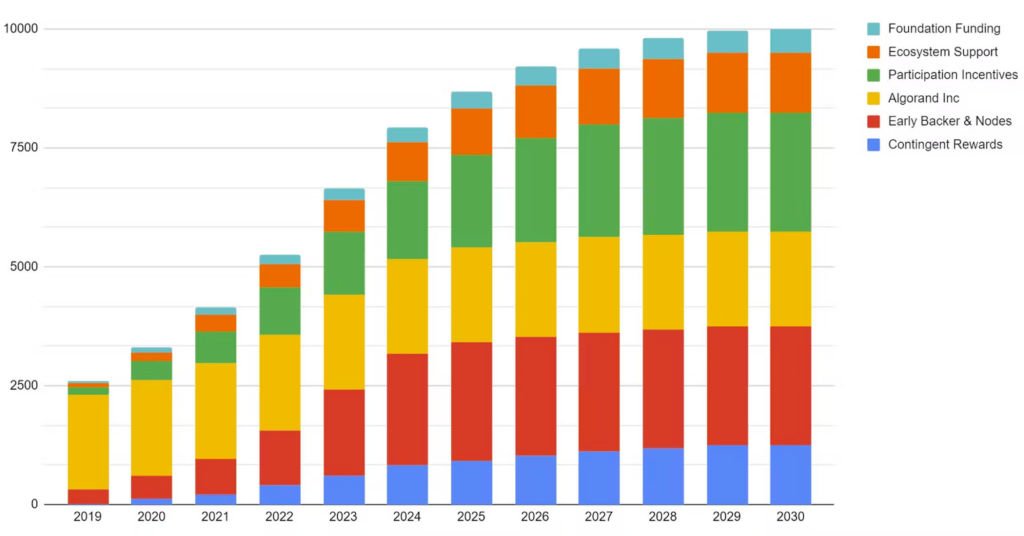

The distribution of ALGO token is as follows:

Algo has an initial supply of 300 billion tokens to reward participation and community governance. Algo, distributed through different forms of ecosystem support and community incentives. There is a maximum supply of 100 billion Algo tokens which will be achievable in 2030.

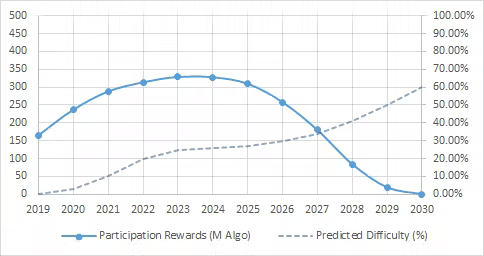

Community incentives or validators and block producers rewards will decrease over time, and the difficulty of attaining them will increase

This means Algo is deflationary assets since block producers’ rewards are getting smaller and complex. There are also more than 200 million Algo tokens that are burnt and lost.

Project On Algorand Blockchain

The Algorand network has smart contract capabilities with its own programming framework called Algorand Virtual Machine (AVM). Algorand also has its own smart-contract programming language called Transaction Execution Approval Language (TEAL). These smart contracts have been implemented into every node in the Algorand blockchain, allowing them to benefit from the platform’s high speed, scalability, and security. Developers may now create any dApp using Algorand while maintaining high execution speed and cost efficiency using the AVM.

Popular project on Algorand:

- AlgoFi

AlgoFi is a decentralized crypto exchange (DEX) platform that combines several DeFi products. Users can use the AlgoFi platform to exchange crypto assets, borrow and lend crypto, and earn interest.

- Folks Finance

Folks Finance is an asset management, lending and borrowing protocol built on Algorand that features liquid staking on Algo token, allowing users to receive a liquid staked token of ALGO when they stake, enabling them to still vote on Algorand governance proposals and earning yield while interacting with DeFi activities

- Lofty

Lofty is a real-estate investment platform that enables users to Invest and own rental properties without getting locked in or out. Users can buy and own just a fraction of a property and are eligible to collect the fraction of rent payment.

While Algorand being decentralized, secure and fast breaking the classic trilemma problem, Algorand still has one major drawback, which is interoperability with other blockchains. Aware of this, the Algorand foundation announced a $10 million dollars grant back in February 2022. A grant called SupaGrant is awarded to teams that can integrate Ethereum virtual machines (EVM) into the Algorand network. This means Algorand developers try to persuade and attract more users and developers from Ethereum.

Closing

There are a lot of positive aspects about Algorand, starting from its blockchain architecture and its increasing real-world use cases to its competent team. As one of the few systems that could potentially resolve the blockchain trilemma, Algorand is an interesting project that has continued to scale with its PPoS consensus method.

While promising, Algorand still has downsides such as lack of marketing and lack of interoperability. While Algorand is recognized as being a highly tech and academical project, it does not showcase it as much as the community may think it should. With strong technology, team and partnerships, we will see what is in store for Algorand in the future.