In the ever-evolving landscape of blockchain technology, new layer-1 (L1) networks are sprouting up like never before. It’s an exhilarating yet challenging task to distinguish the true game-changers from fleeting trends. Among these innovative platforms, one has recently caught our attention – the Sui blockchain.

With its arrival earlier this year, Sui brings forth a captivating combination of unique features that sets it apart from the rest. Its distinctiveness is not just a passing fad; the recent announcement of a groundbreaking $300 million Series B funding round solidifies Sui’s position as a force to be reckoned with in the blockchain realm.

What Is Sui Blockchain (SUI)?

Mysten Labs, the organization behind the Sui blockchain, is a prominent player in the Web3 infrastructure space. With its inception earlier this year, Mysten Labs brings together a team of experts in cryptography, programming languages, and distributed systems. Notably, the founders have a strong background in the field, having previously led Meta’s Novi Research and contributed to the development of the Move programming language.

Sui positions itself as the pioneering permissionless layer-1 (L1) proof-of-stake (PoS) blockchain developed from scratch, empowering developers and creators to construct Web3 projects that cater to the next generation of Web3 users. With a focus on high throughput and low latency, Sui serves as a next-generation smart contract platform. It utilizes an asset-oriented programming model based on the Move smart contract language.

The platform promises unparalleled low latency and scalability for simple use cases by enabling parallel transactions. This allows Sui to utilize processing resources more efficiently.

When it comes to straightforward tasks like asset transfers and payment transactions, the platform bypasses traditional consensus mechanisms. Instead, it employs simpler and low-latency primitives, a unique approach in the blockchain industry. This approach empowers developers to build latency-sensitive decentralized applications (dApp) in various domains, including retail payments and gaming.

A permissionless set of validators maintains the blockchain platform, assuming roles similar to miners or validators in other prominent blockchain systems. Additionally, the platform has its native token called “SUI,” which plays a vital role in the network’s functionality.

How Does Sui Blockchain Work?

The Sui blockchain leverages three fundamental elements that synergistically enable it to achieve instant settlements at a low cost:

Move Language

The Sui blockchain utilizes the Sui Move language to execute smart contracts. Sui Move is an updated version of the Move language used by Aptos. It is based on the popular Rust programming language, originally developed by Facebook (now known as Meta) for its discontinued blockchain project, Diem. Sui Move is an executable bytecode language designed to prevent double-spending and enhance the security of smart contracts on the Sui platform. It addresses some of the flaws and imperfections of existing programming languages like Solidity, ensuring more secure representation of blockchain assets.

Unlike traditional blockchain networks that design smart contracts around accounts, Sui’s smart contracts are based on programmable objects. These objects can be mutable or immutable, shared among multiple users, or owned by a single individual. Objects owned exclusively by a single user do not require the verification process, resulting in near-instant finality.

Parallel Transaction Execution

A significant innovation offered by Sui is parallel transaction execution. In other platforms, smart contract transactions are processed sequentially, often in the order they are received, leading to slower transaction processing times. However, the Sui blockchain processes transactions in parallel, and simple transactions do not require consensus, allowing for near-instant finality. By comparison, at its peak, the Ethereum blockchain can handle approximately 15 transactions per second (TPS), while the Sui network has demonstrated the ability to process 120,000 transactions in a single second during trial runs.

Sui Consensus Engine

During its launch, Sui initially employed the Tusk and Narwhal consensus algorithms, with Bullshark replacing Tusk as the primary option in August 2022. This change was made to address latency issues and ensure that validators with lower processing speeds can still contribute to the network. Tusk can still be used by updating the source code. Narwhal serves as a mempool to ensure the availability of data submitted for consensus, while Bullshark (or Tusk) establishes the standard for organizing the data, allowing the consensus engine to read it. This utilization of a directed acyclic graph (DAG) mempool is yet another innovation introduced by Sui.

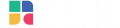

Sui Economy Features

Sui operates on a delegated proof of stake (DPoS) mechanism, where SUI holders choose a group of validators and stake their SUI tokens with them during each epoch, which lasts for 24 hours. These validators are responsible for processing transactions on the network. The staked tokens remain locked within the system for the duration of the epoch, but token holders have the flexibility to withdraw their tokens or change their delegated validator when the epoch transitions to the next period.

Source: docs.sui.io

Gas-Pricing Mechanism

The gas price system in the Sui network was designed with three main objectives, all aimed at improving the user experience and ensuring a fast and reliable network:

● Keeping gas fees low: The gas fees are based on a simple and easily computed formula, helping to maintain affordable transaction costs for users.

● Incentivizing efficient validator performance: Validators are encouraged to perform their work efficiently by setting a minimum gas price they are willing to accept. Their performance is compared to other validators, and those who meet or exceed the reference gas price receive regular rewards, while those who fall short have their rewards reduced.

● Protecting against denial of service attacks: The gas price system adds a layer of protection to the network, preventing it from being vulnerable to malicious attacks that could disrupt its operation.

At the start of each epoch, validators provide their minimum acceptable gas price, and the system determines a price around the 66th percentile based on this information. Throughout the epoch, validators receive signals about each other’s operations, allowing them to evaluate their performance relative to others and strive to meet the reference gas price. This mechanism encourages validators to set a lower minimum acceptable gas price and commit to it, which ultimately helps to keep costs down for users.

Storage Fund

The Sui blockchain’s sustainability relies on the storage fund, which securely holds the network’s gas fees and redistributes them to validators. This incentivizes validators to continue their work and ensures the network’s ongoing operation.

To maintain the storage fund size, a careful balance is maintained between inflows and outflows. There are two types of inflows: transactional storage fees collected during the current epoch and reinvestments of unallocated staked rewards, which contribute to the fund’s principal. On the other hand, outflows occur when users delete unnecessary data in exchange for a storage fee rebate.

Importantly, validator rewards are exclusively paid from the interest generated by the fund, leaving the principal untouched. This approach guarantees the fund’s self-sustainability, enabling the ecosystem to persist indefinitely.

The SUI Token

SUI is the native token of the Sui blockchain, and it is designed with a fixed supply of 10,000,000,000 (ten billion) tokens. At the launch of the mainnet, a portion of the total supply will be immediately available, while the remaining tokens will vest over time or be distributed as stake reward subsidies. Each SUI token is divisible into a significant number of decimal places. The SUI token serves multiple functions within the Sui ecosystem, contributing to its overall functionality and operations.

Specifically, the SUI token serves four primary functions within the Sui ecosystem:

- Transaction Fees: SUI is utilized to pay for gas fees associated with on-chain transactions and other operations within the platform.

- Staking: Holders of SUI have the opportunity to stake their tokens, allowing them to participate in the proof-of-stake (PoS) mechanism of the Sui blockchain and earn rewards.

- Medium of Exchange/Store of Value: SUI functions as an asset that can be used as a medium of exchange or a store of value within the Sui ecosystem.

- Governance: SUI token holders have the right to participate in the governance of the Sui blockchain. This includes the ability to vote on important decisions and proposals that affect the future development and direction of the platform.

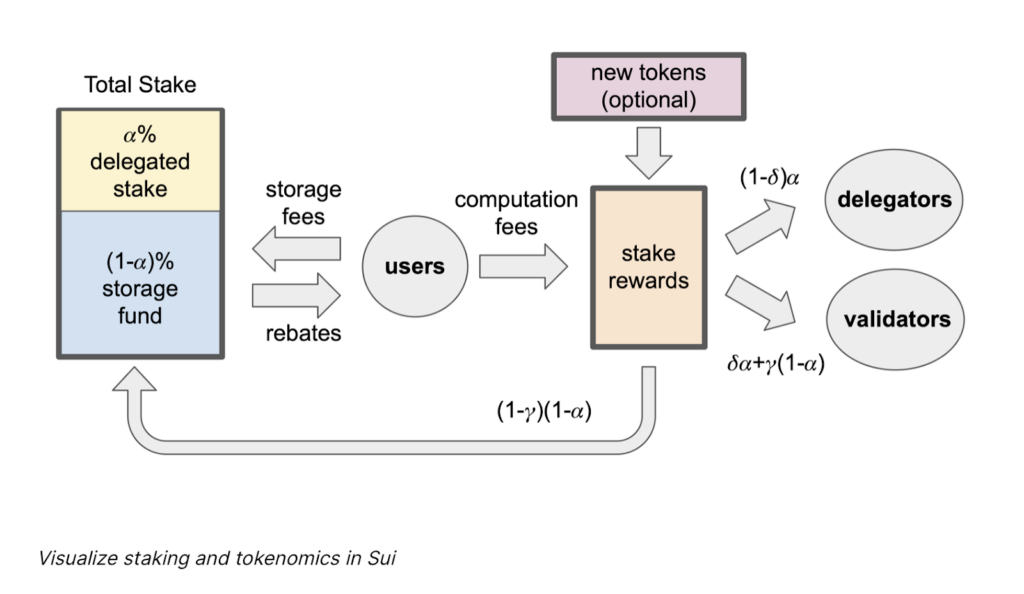

SUI Token Distribution

The launch of the Sui Mainnet brings significant changes as it enables developers who have been building on Sui’s Devnet and Testnet environments to now handle real assets. This includes dynamic and composable NFTs, highly efficient payment and trading systems for fungible tokens, and much more. With the Sui Mainnet, validators are now processing real transactions, and SUI stakers actively participate in the network’s operations. This milestone represents a crucial step towards Sui’s goal of achieving full decentralization.

The Sui Foundation plays a vital role in supporting and empowering builders and creators within the Sui ecosystem. It takes the lead in spearheading decentralization efforts by distributing SUI tokens throughout the community to be utilized for their best purposes. The Community Reserve, managed by the Sui Foundation, holds over half of all SUI tokens, which will be utilized across various community programs, including:

- Delegation Program: The Foundation assists in bootstrapping community-run validators and ensures an equitable distribution of stakes among network validators by delegating its stake to aligned third parties.

- Grant Programs: The Foundation directly distributes tokens to developers, community ambassadors, and other participants who contribute to the development of Sui. These tokens support the creation of educational materials that facilitate the onboarding process into the Sui ecosystem.

- Research and Development: The Foundation provides support for advancing the Sui protocol, ensuring that it remains technologically innovative even in the distant future.

- Validator Subsidies: A significant portion of tokens has been allocated by the Foundation to subsidize stake rewards during the network’s early stages.

In addition to the efforts of the Sui Foundation, Sui community members will have the opportunity to purchase the SUI token during the early stages of the Sui Mainnet. The Community Access Program allows Sui enthusiasts to acquire SUI directly without having to participate in the Foundation’s programs. These tokens will also support community members who have actively engaged with and tested Sui Apps, contributing to the improvement of Sui’s ecosystem during the devnet and testnet phases.

Source: https://blog.sui.io/

Is Sui Token a Good Investment?

Sui has gained significant popularity in a short time, launching various initiatives, including a mainnet and the DeepBook limit order book. Our analysis suggests that the SUI Network is a promising project poised for further growth. With a strong community, the SUI Token is one of the fastest-growing blockchain projects. Long-term investment in Sui Token seems favorable based on our price analysis.

📒DeepBook, Sui’s native Central Limit Order Book (CLOB), is almost ready for prime time. It's in final testing and you're invited to participate.

— Sui (@SuiNetwork) May 9, 2023

Builders can start integrating with DeepBook now so your app is ready when the time comes.

Learn more.👇https://t.co/vqjnDLwD27

Although Sui Token shows bullish long-term growth, it’s important to note that cryptocurrencies, including Sui, are highly volatile and subject to price fluctuations. As a smart investor considering long-term investments, Sui Coin can be an excellent choice. However, it’s crucial to practice proper risk management, as cryptocurrencies are both beneficial and risky assets. Before making any investment decisions, conduct thorough research and implement appropriate risk mitigation strategies.

Conclusion

Sui blockchain has emerged as a game-changing platform in the ever-evolving landscape of blockchain technology. With its unique features and recent $300 million Series B funding round, Sui solidifies its position as a force to be reckoned with. Developed from scratch as a permissionless layer-1 proof-of-stake blockchain, Sui empowers developers to build next-generation Web3 projects. It boasts high throughput, low latency, and parallel transaction execution, allowing for near-instant finality. The SUI token plays a vital role, serving as a medium of exchange, governance tool, and stake in the proof-of-stake mechanism. With the support of the Sui Foundation and the Community Access Program, Sui aims to achieve full decentralization while driving innovation in the blockchain ecosystem.