Illiquidity poses a significant challenge when it comes to staking on proof-of-stake (PoS) blockchains. Once users lock their funds, they are unable to withdraw or access their tokens until the lock-up period expires. As a result, they miss out on the opportunity to earn additional yields from other decentralized finance (DeFi) protocols during this time.

Furthermore, there are considerable barriers to entry, including high costs associated with running a node and the complexity involved in setting up validators. These factors discourage many retail users from participating in PoS staking. To address these issues, Lido offers a compelling alternative with its liquid staking solution.

Introduction

Introduced in 2020, Lido (LDO) serves as a liquid staking solution designed for proof-of-stake (PoS) cryptocurrencies. It facilitates staking in the post-Ethereum Merge consensus layer (formerly known as Ethereum 2.0) as well as other PoS blockchains such as Polygon, Kusama, Solana, and Polkadot.

But who is the driving force behind Lido? To ensure decentralized governance of the protocol, a decentralized autonomous organization (DAO) was established within the network. This DAO is responsible for making crucial decisions regarding the operations of the protocol. This framework enables Lido to align its actions with the best interests of its stakeholders while maintaining a decentralized and transparent approach.

The governing rights within the Lido DAO are allocated through the native crypto asset of the protocol, LDO. Each LDO token grants its holder the power of one vote, with the voting influence proportional to the stake held by the tokenholder in the network.

One significant distinction between Lido and other protocols lies in its upgradable and adjustable voting mechanism. Importantly, this mechanism remains independent of other adaptable protocols on the blockchain. This unique characteristic empowers the Lido DAO to implement governance structure changes while preserving the platform’s other functions.

By employing this model, Lido aims to strike a balance between democratic decision-making, flexibility in governance, and the integrity and efficiency of its protocol’s functionalities.

What is Liquid Staking?

While traditional staking involves locking one’s cryptocurrency assets for a specific duration in exchange for yields, liquid staking offers a solution to the drawback of token lock-up.

In liquid staking, users receive tokenized representations of their deposited funds, known as stAsset tokens, on a 1:1 basis. Alongside earning staking yields, users can also generate additional returns by utilizing the stAsset tokens as collateral for loans or engaging in yield farming on various decentralized finance (DeFi) protocols.

For example, if a user decides to stake two Ether (ETH) tokens, they will receive two stETH tokens in return. Similarly, staking two Polygon (MATIC) tokens will result in the issuance of two stMATIC tokens.

By enabling tokenization and maintaining a 1:1 ratio, liquid staking provides users with increased flexibility. They can leverage their stAsset tokens in DeFi activities, accessing further earning opportunities while still benefiting from the staking rewards originally earned through their initial deposits.

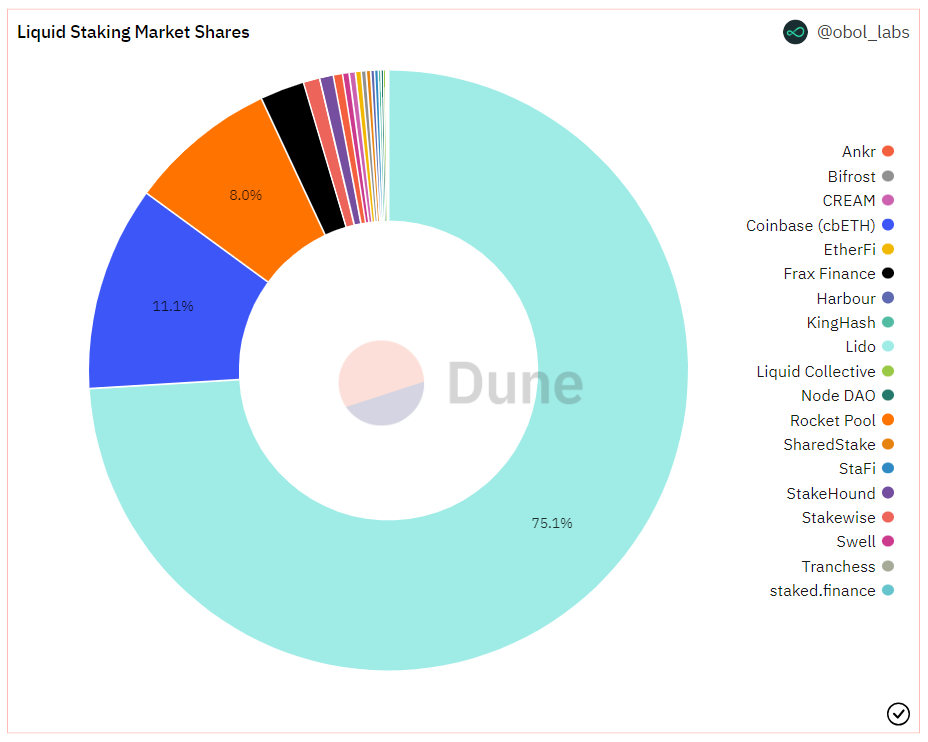

Market share of the liquid staking sector on Ethereum. Source: Dune Analytics

Does Lido Work on Other Blockchains?

Yes, Lido extends its services to other proof-of-stake (PoS) blockchains as well. Users have the opportunity to stake LDO tokens on various PoS networks, enabling them to participate in staking activities beyond Ethereum.

| Network | Features | Staking Token | Benefits |

|---|---|---|---|

| Ethereum | – Pooling ETH staked from multiple users – Capital-efficient model with one asset deposit |

stETH | – No collateral requirement for nodes |

| Solana | – Similar benefits to Ethereum (liquid staking, DeFi integrations) – Instant liquidity |

stSOL | – Simplified staking for end-users |

| Polygon | – Stake MATIC tokens on Ethereum for stMATIC – Increase security and decentralization of the Polygon network |

stMATIC | – Utilize stMATIC holdings on other DeFi protocols – Contribute to the utility of stMATIC tokens |

| Polkadot | – Stake Polkadot (DOT) tokens for stDOT – Asset-growing mechanism with distribution to node operators |

stDOT | – Earn rewards and utilize stDOT tokens while DOT tokens are locked – Increase the network’s pooled assets |

| Kusama | – Stake Kusama (KSM) for stKSM – Utilization across Kusama and Moonriver ecosystems |

stKSM | – Daily staking rewards |

Who Invented Lido DAO?

Lido DAO was created by a team of experienced developers and blockchain experts, including Jordan Fish, Vasiliy Shapovalov, and Kasper Rasmussen. The project aims to provide a more accessible and decentralized approach to staking on the Ethereum network.

The Lido DAO benefits from the expertise of its core team members: Jordan Fish, a seasoned entrepreneur with a background in software development and cryptocurrency investing; Vasiliy Shapovalov, a skilled blockchain engineer with experience in various blockchain projects; and Kasper Rasmussen, a talented software engineer specializing in decentralized applications and smart contracts. Their combined knowledge and proficiency contribute to the success and innovation of Lido DAO in the realm of decentralized staking and the advancement of the Ethereum ecosystem.

Since its launch in November 2020, Lido DAO has gained attention for its unique staking solution. It has received support from renowned investors such as Coinbase Ventures, Digital Currency Group, and ParaFi Capital.

The team behind Lido DAO is committed to making staking on Ethereum more user-friendly and has garnered recognition from key figures in the crypto community, including Vitalik Buterin, the co-founder of Ethereum.

Through their expertise and dedication, the Lido DAO team continues to drive innovation in decentralized staking, empowering users within the Ethereum ecosystem.

How Does Lido (LDO) Work?

When staking through Lido, ETH holders receive stETH, an stToken that serves as a representation of the locked ETH. The beauty of stETH is that it can be used just like regular ETH on various DeFi platforms that have integrated support for Lido’s stTokens. Popular DeFi apps such as Metamask, AAVE, Uniswap, and others have embraced Lido’s stTokens, offering users a range of possibilities.

The primary advantage of stTokens is that they allow users to unlock the value of their staked tokens, thereby increasing their yield potential. Upon staking, users receive stTokens in exchange for their locked assets. These stTokens act as virtual poker chips, representing the underlying value of the staked asset. They can be utilized in DeFi activities such as yield earning, decentralized lending, providing liquidity, trading on decentralized exchanges (DEXs), and more.

Initially focused solely on Ethereum, Lido has expanded its support to several additional blockchains, including Polygon, Solana, Polkadot, and Kusama. Each supported digital asset has its corresponding stToken. In addition to stTokens, Lido’s DAO leverages LDO, the governance token that facilitates decentralized decision-making within the DAO.

Lido’s commitment to offering a wide range of stTokens and integrating with various DeFi platforms reflects its dedication to providing users with flexibility and access to a vibrant ecosystem. By expanding beyond Ethereum and offering support for multiple blockchains, Lido has become a versatile solution for users seeking to maximize the potential of their staked assets.

What is LDO Token?

The LDO token serves as the native token of the Lido Finance platform and operates as an ERC-20 token. It plays a crucial role in platform governance, as each LDO token represents one voting right. Holders of LDO tokens have the power to propose and vote on changes to the Lido platform. When proposals are made, LDO token holders participate in the voting process, and the outcome is determined by the majority of votes.

Lido Finance collects a staking fee as part of its platform operations. Specifically, a 10% fee is applied to staking rewards, which is then distributed between the node operators and the Lido DAO. The Lido DAO receives 5% of all staking rewards, contributing to the increased value of the LDO token.

By using the LDO token for governance and distributing a portion of staking rewards to token holders, Lido Finance encourages active participation from the community and aligns the platform’s growth with the interests of its users.

Tokenomics

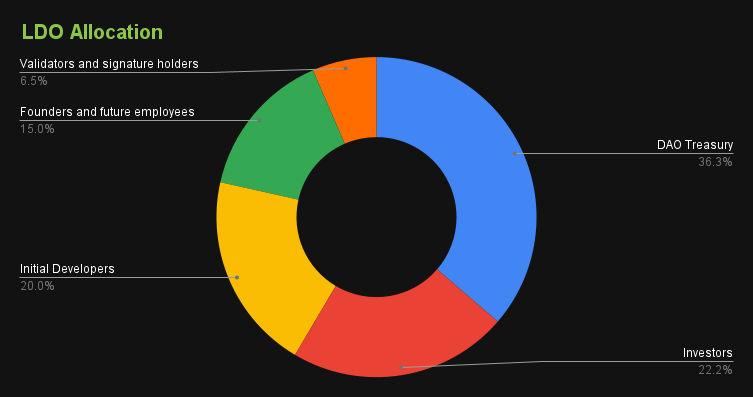

The Lido DAO introduced a total of 1 billion LDO tokens upon its launch.

As of the current time, the founding members of the Lido DAO hold 64% of the LDO tokens. These tokens are subject to a 1-year lock-up period and will be vested over the course of 1 year. At present, only a small portion of LDO tokens are unlocked, comprising 0.4% that was distributed as an airdrop to early stakers and tokens held in the DAO treasury. The usage of these unlocked tokens can be proposed by anyone through research.lido.fi.

The distribution of LDO tokens is as follows:

- DAO treasury: 36.32%

- Investors: 22.18%

- Validators and signature holders: 6.5%

- Initial Lido developers: 20%

- Founders and future employees: 15%

This allocation ensures a balanced distribution of LDO tokens among various stakeholders, including the DAO treasury, investors, validators, developers, founders, and future employees.

Should We Invest in LDO Token?

Investing in Lido DAO (LDO) opens up a world of exciting possibilities in the ever-evolving DeFi landscape. With its innovative approach to staking and unwavering commitment to accessibility, Lido DAO has caught the attention of both seasoned investors and newcomers alike.

Backed by reputable investors and guided by a talented team of experts, Lido DAO stands out as a project with tremendous growth potential. Its aim to democratize staking and make it accessible to a wider audience sets it apart in the market.

While every investment carries inherent risks, Lido DAO’s strong foundation and strategic partnerships instill confidence in its long-term prospects. By joining the Lido DAO community, you have the opportunity to participate in shaping the future of decentralized finance and earn rewards for contributing to the security of the network.

As with any investment decision, conducting thorough research and understanding your risk tolerance is crucial. Explore the exciting world of Lido DAO, and consider how this innovative project can fit into your investment portfolio. Take the leap and seize the potential that Lido DAO holds in the dynamic DeFi space.

Conclusion

In conclusion, Lido DAO (LDO) offers a groundbreaking solution to the challenges of illiquidity in staking on proof-of-stake blockchains. By providing a liquid staking alternative, Lido DAO allows users to earn staking rewards while maintaining the flexibility to access their assets and participate in other DeFi opportunities. With a team of experienced developers and support from reputable investors, Lido DAO is at the forefront of innovation in the DeFi space. By investing in Lido DAO, you can join a vibrant community and actively contribute to the future of decentralized finance while potentially earning rewards.